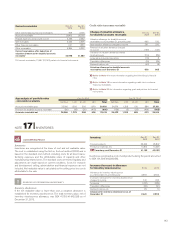

Volvo 2013 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

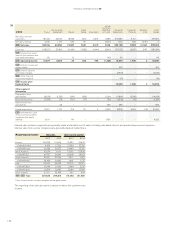

Credit loss reserves

The establishment of credit loss reserves on customer-fi nancing receivables

is dependent on estimates including assumptions regarding past dues, repos-

session rates and the recovery rate on the underlying collaterals. As of

December 31, 2013, the total credit loss reserves in the Customer Finance

segment amounted to 1.31% (1.23) of the total credit portfolio in the segment.

Refer to Note 4 for a description of the credit risk, interest and currency risks

and Note 30 for further information regarding customer-fi nancing receivables.

Volvo Group Non-current customer-fi nancing receivables

Allocation of non-current customer-

fi nancing receivables Dec 31,

2013 Dec 31,

2012

Installment credits 21,850 19,314

Financial leasing 21,040 21,115

Other receivables 902 727

B/S Non-current customer fi nancing

receivables as of December 31 43,792 41,156

The effective interest rate for non-current customer-fi nancing receivables

amounted to 5.61 % (6.31) as of December 31, 2013.

Volvo Group Current customer-fi nancing receivables

Allocation of current customer-

fi nancing receivables Dec 31,

2013 Dec 31,

2012

Installment credits 11,597 10,884

Financial leasing 13,808 13,748

Dealerfi nancing 13,676 14,079

Other receivables 988 1,122

B/S Current customer fi nancing

receivables as of December 31 40,069 39,833

The effective interest rate for current customer-fi nancing receivables

amounted to 5.63% (6.06) as of December 31, 2013.

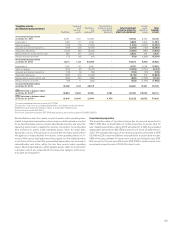

Volvo Group Credit risk in the customer-fi nancing operations

Volvo Group Customer-fi nancing

receivables Dec 31,

2013 Dec 31,

2012

Customer-fi nancing receivables gross 85,040 82,080

Valuation allowance for doubtful customer-fi nancing

receivables (1,179) (1,091)

Whereof specifi c reserve (316) (258)

Whereof other reserve (863) (833)

Customer-fi nancing receivables, net 83,861 80,989

Volvo Group Customer-fi nancing

receivables (days/SEK M)

payments due

Dec 31, 2013 Dec 31, 2012

Not due 1–30 31–90 >90 Total Not due 1–30 31–90 >90 Total

Overdue amount – 863 279 626 1,768 – 407 331 404 1,142

Valuation allowance for doubtful customer fi nancing

receivables (84) (70) (37) (125) (316) (64) (42) (43)(109)(258)

Customer-fi nancing receivables,

net book value (84) 793 242 501 1,452 (64) 365 288 295 884

The table above presents overdue payments within the customer fi nancing operations in relation to specifi c reserves. It is not unusual for a receivable

to be settled a couple of days after its due date, which impacts the age interval of 1–30 days.

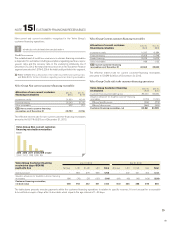

SOURCES OF ESTIMATION UNCERTAINTY

!

Non-current and current receivables recognized in the Volvo Group’s

customer fi nancing operations.

2018

3,096

2019 or later

844

2017

7,398

2016

13,414

2015

19,040

Volvo Group Non-current customer-

fi nancing receivables maturities

MSEK

NOTE 15 CUSTOMER-FINANCING RECEIVABLES

141