Volvo 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

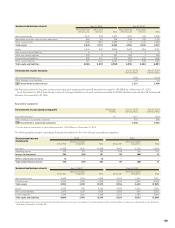

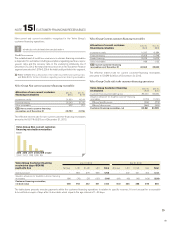

OTHER OPERATING

INCOME AND EXPENSES

NOTE 8

Changes in provisions for doubtful accounts receivable and customer-

fi nancing receivables are recognized in Other operating income and expenses.

Other operating income and expense 2013 2012

Gains/losses on divestment of Group companies 144 596

Revaluation of assets held for sale1(1,458) –

Change in allowances and write-offsfor doubtful

receivables, customer fi nancing (923) (640)

Change in allowances and write-offsfor doubtful

receivables, other (299) (105)

Damages and litigations (117) (175)

Restructuring costs2(707) (1,524)

Volvo profi t sharing program (15) (208)

Other income and expenses (179) (41)

I/S Total (3,554) (2,096)

1 Including revaluation of Volvo Rents.

2 Restructuring costs are mainly related to the Group wide effi ciency program

which impacted the Group with an amount of SEK 715 M (1,550).

Read more regarding the company’s management of credit risk and credit

reserves in Note 4.

OTHER FINANCIAL INCOME

AND EXPENSES

NOTE 9

The unrealized losses from derivatives used to hedge interest rate expo-

sure are mainly related to the customer fi nance portfolio. The unrealized

and realized gains from derivatives used to hedge future cash fl ow exposure

in foreign currency are primarily an effect of SEK 283 M (–) from deriva-

tives used to hedge future cash fl ow of the acquisition of Dongfeng Com-

mercial Vehicles.

Other fi nancial income and expense 2013 2012

Gains and losses on derivatives used to hedge

interest rate exposure (66) 8

Gains and losses on derivatives used to hedge

foreign cash fl ow exposure 274 223

Financial instruments at fair value

through profi t or loss 208 231

Exchange rate gains and losses on fi nancial assets

and liabilities 101 (9)

Financial income and expenses related to taxes (22) (34)

Costs for Treasury function, credit facilities, etc (276) (266)

I/S Total111 (78)

1 Other fi nancial income and expenses attributable to fi nancial instruments

amounted to positive SEK 309 M (222).

Refer to Note 30 for information regarding Financial Instruments.

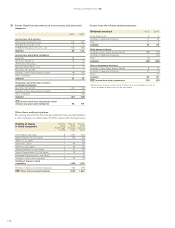

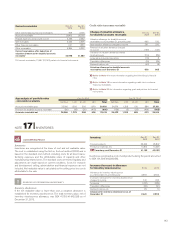

The Volvo Group’s recognized net sales pertain mainly to revenues from

sales of goods and services. Net sales are, if the occasion arises, reduced

by the value of discounts granted and by returns.

Revenue from the sale of goods is recognized when signifi cant risks

and rewards of ownership have been transferred to external parties, nor-

mally when the goods are delivered to the customer. However, if the sale of

goods is combined with a buy-back agreement or a residual value guaran-

tee, the transaction is recognized as an operating lease transaction if sig-

nifi cant risks in regard to the goods are retained in Volvo Group. Revenue

is then recognized over the period of the residual value commitment. If the

residual value risk commitment is not signifi cant or the sale was made to an

independent party before Volvo Group is committed to the residual value

risk the revenue is recognized at the time of sale and a provision is made

to refl ect the estimated residual value risk (refer also to Note 21 Other pro-

visions for description of residual value risk). If sale is in combination with a

commitment from the customer to buy a new Volvo product in connection

to a buy-back option, revenue is recognized at the time of the sale.

Revenue from the sale of workshop services is recognized when the ser-

vice is provided. Interest income in conjunction with fi nance leasing or instal-

ment contracts are recognized during the underlying contract period. Rev-

enue for maintenance contracts are recognized in line with the allocation

of associated costs over the contract period.

Interest income is recognized on a continuous basis and dividend income

when the right to receive dividend is obtained.

ACCOUNTING POLICY

SOURCES OF ESTIMATION UNCERTAINTY

!

Buy-back agreements and residual value guarantees

In certain cases, Volvo Group enters into a buy-back agreement or resid-

ual value guarantee after Volvo Group has sold the product to an inde-

pendent party or in combination with an undertaking from the customer to

purchase a new product in the event of a buy-back. In such cases, there

may be a question of judgement regarding whether or not signifi cant risks

and rewards of ownership have been transferred to the customer. If it is

determined that such an assessment was incorrect, the Volvo Group’s

recognized revenue and income for the period will decline and instead be

distributed over several reporting periods.

Refer to note 21, Other provisions, for a description of residual value risks.

Hard and soft products

The Volvo Group’s product range is divided into hard and soft products.

The sale of new vehicles, machinery and engines comprise hard products

as well as the sale of used vehicles and machines, trailers, superstruc-

tures and special vehicles. Soft products are defi ned as the sale of ser-

vices and aftermarket products.

Refer to page 38 World-class services for more information about the Volvo

Group’s services.

Refer to Note 6 for information regarding net sales by product and market.

NOTE 7 INCOME

133