Volvo 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For the Volvo Group, the year 2013 was characterized by the most extensive product renewal in the history

of the Group, with associated costs in manufacturing, sales, administration and research and development,

as well as costs connected to restructuring primarily within the truck operations. Net sales amounted to

SEK 273 billion and operating income to SEK 7.1 billion.

FINANCIAL PERFORMANCE

Lower earnings

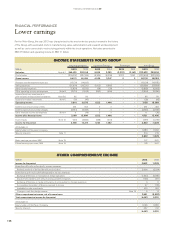

INCOME STATEMENTS VOLVO GROUP

Industrial operations Customer Finance Eliminations Volvo Group

SEK M 2013 2012 2013 2012 2013 2012 2013 2012

Net sales Note 6,7 265,420 292,198 9,539 9,783 (2,337) (2,167) 272,622 299,814

Cost of sales (209,307) (227,745) (5,534) (6,036) 2,337 2,167 (212,504) (231,615)

Gross income 56,113 64,454 4,005 3,747 0 0 60,118 68,199

Research and development expenses (15,124) (14,635) – – – – (15,124) (14,635)

Selling expenses (26,904) (26,230) (1,602) (1,665) – – (28,506) (27,894)

Administrative expenses (5,824) (5,535) (38) (29) – – (5,862) (5,563)

Other operating income and expenses Note 8 (2,710) (1,538) (843) (556) – – (3,554) (2,096)

Income (loss) from investments in

joint ventures and associated companies Note 5,6 96 99 – – – – 96 99

Income from other investments Note 5 (31) (42) – – – – (30) (42)

Operating income 5,616 16,573 1,522 1,496 – – 7,138 18,069

Interest income and similar credits 381 453 0 0 – – 381 453

Interest expenses and similar charges (2,810) (2,949) 0 0 – – (2,810) (2,949)

Other fi nancial income and expenses Note 9 11 (78) 0 0 – – 11 (78)

Income after fi nancial items 3,199 13,999 1,522 1,496 – – 4,721 15,495

Income taxes Note 10 (451) (3,682) (468) (434) – – (919) (4,116)

Income for the period 2,748 10,317 1,054 1,062 – – 3,802 11,378

Attributable to:

Equity holders of the parent company 3,583 11,160

Minority interests Note 11219219

3,80211,378

Basic earnings per share, SEK Note 19 1.77 5.61

Diluted earnings per share, SEK Note 19 1.76 5.61

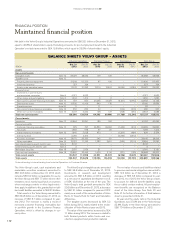

OTHER COMPREHENSIVE INCOME

SEK M 2013 2012

Income for the period 3,802 11,378

Items that will not be reclassifi ed to income statement:

Remeasurements of defi ned benefi t pension plans 3,904 (2,234)

Items that may be reclassifi ed subsequently to income statement:

Exchange differences on translation of foreign operations (1,634) (3,395)

Share of OCI related to joint ventures and associated companies (135) (191)

Exchange differences on hedge instruments of net investment in foreign operations 0 0

Accumulated translation difference reversed to income 37 (118)

Available-for-sale investments 470 343

Change in cash fl ow hedge reserve Note 19 9 8

Other comprehensive income, net of income taxes 2,651 (5,587)

Total comprehensive income for the period 6,453 5,791

Attributable to:

Equity holders of the Parent Company 6,196 5,655

Minority interests 257 136

6,453 5,791

108

FINANCIAL INFORMATION 2013

108