Volvo 2013 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Subsidiaries

The Volvo Group has production facilities in 18 countries and sales of prod-

ucts in more than 190 markets which mean that the Volvo Group has sub-

sidiaries in many parts of the world. A subsidiary is defined as an entity that

is controlled by the Volvo Group. A subsidiary is controlled by a parent com-

pany when it has power over the investee, exposure, or rights, to variable

returns from its involvement with the investee and the ability to use its

power over the investee to affect the amount of the investor’s return. Most

of the Volvo Group’s subsidiaries are owned to 100% by the Volvo Group

and are therefore considered to be controlled by the Volvo Group. For some

subsidiaries there are restrictions on the Volvo Group’s ability to access or

use cash from these subsidiaries, for more information on cash that is not

available or with other limitations see note 18.

Read more about minority interests in N ote 11. For more information about

the composition of the Volvo Group see Note 13 for the parent company.

Joint ventures

Joint ventures are companies over which the Volvo Group has controlling

influence together with one or more external parties. Joint ventures are as

from January 1, 2013, recognized by applying equity accounting, in accord-

ance with IFRS 11 Joint arrangements. Joint ventures were previously rec-

ognized by applying the proportionate consolidation method. All three joint

ventures owned by the Volvo Group are of business related nature.

Read more about changes in the Volvo Group’s accounting for Joint Ventures

as from January 1, 2013 in Note 31.

Associated companies

Associated companies are companies in which the Volvo Group has a sig-

nificant influence, normally when the Group’s holdings equal at least 20%

but less than 50% of the voting rights. Holdings in associated companies

are recognized in accordance with the equity method.

Equity method

The Volvo Group’s share of income in companies recognized according to

the equity method is included in the consolidated income statement under

Income (loss) from investments in joint ventures and associated compa-

nies, less, where appropriate, depreciation of surplus values and the effect

of applying different accounting policies. Income from companies recog-

nized in accordance with the equity method is included in operating income

since the Volvo Group’s investments are of operating nature. For practical

reasons, some of the associated companies are included in the consoli-

dated financial statements with a certain time lag, normally one quarter.

Dividends from joint ventures and associated companies are not included

in consolidated income. In the consolidated balance sheet, investments in

joint ventures and associated companies are affected by the Volvo Group’s

share of the company’s net income, less depreciation of surplus values

and dividends received.

Other shares and participations

Holding of shares that do not provide the Volvo Group with significant in-

fluence, which generally means that Volvo Group’s holding of shares cor-

responds to less than 20% of the votes, are recognized as other shares

and participations. For listed shares, the carrying amount is equivalent to the

market value. Unlisted shares and participations, for which a fair value can-

not reasonably be determined, are measured at cost less any impairment.

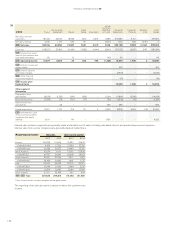

Joint ventures

The Volvo Group’s investments in joint ventures are listed below.

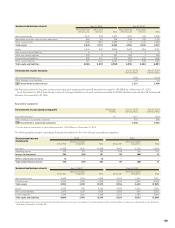

Shares in joint ventures Dec 31, 2013 Dec 31, 2012

Holding percentage Holding percentage

Shanghai Sunwin Bus Corp., China 50 50

DONGVO Truck Co., Ltd. (former

Dong Feng Nissan Diesel Motor

Co., Ltd.,) China 50 50

VE Commercial Vehicles, Ltd., India145.6 45.6

1 VE Commercial Vehicles (VECV) is considered to be a joint venture as Volvo Group

and Eicher Motors Ltd have signed an agreement which states that common

agreement is needed in relation to important questions related to the govern-

ance of VECV. Read more in Note 31 regarding changes in the Volvo Group’s

financial reporting 2013.

ACCOUNTING POLICIES

INVESTMENTS IN JOINT VENTURES, ASSOCIATED

COMPANIES AND OTHER SHARES AND PARTICIPATIONS

NOTE 5

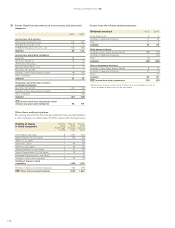

The following tables present summarized financial information for the Volvo Group’s joint ventures:

Summarized income statements 2013 2012

VE Commercial

Vehicles, Ltd. Other joint

ventures Total VE Commercial

Vehicles, Ltd. Other joint

ventures Total

Net sales 5,516 1,291 6,807 6,604 1,803 8,407

Operating income1342 (52) 290 440 (10) 430

Interest income and similar credits 60 161 113 1114

Interest expense and similar charges (10) (39) (49) (6) (34) (40)

Other financial income and expenses (2) (1) (3) 0(1) (1)

Income taxes (84) (5) (89) (140) 4(136)

Income for the period 306 (96) 210 407 (40) 367

Other comprehensive income (298) 12 (286) (221) (26) (247)

Total comprehensive income 8(84) (76) 186 (66) 120

1 Depreciation and amortization of 138 (112) are included within operating income.

128

FINANCIAL INFORMATION 2013

128