Volvo 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACCOUNTING POLICY

Recognition of business combinations

The Volvo Group applies IFRS 3, Business Combinations, for acquisitions.

All business combinations are recognized for in accordance with the pur-

chase method. Volvo Group measures acquired identifi able assets, tangi-

ble and intangible, and liabilities at fair value. Any surplus amount from the

purchase price, possible non-controlling interests and fair value of previ-

ously held equity interests at the acquisition date compared to the Volvo

Group’s share of acquired net assets is recognized as goodwill. Any defi cit

amount, known as negative goodwill, is recognized in the income statement.

In step acquisitions, a business combination occurs only on the date

control is achieved, which is also the time when goodwill is calculated.

Transactions with the minority are recognized as equity as long as control

of the subsidiary is retained. For each business combination, the Volvo Group

decides whether the minority interest shall be valued at fair value or at the

minority interest’s proportionate share of the net assets of the acquiree. All

acquisition-related costs are expensed. Companies acquired during the

year are consolidated as of the date of acquisition. Companies that have

been divested are included in the consolidated fi nancial statements up to

and including the date of the divestment.

Non-current assets held for sale and discontinued operations

The Volvo Group applies IFRS 5, Non-current Assets Held for Sale and

Discontinued Operations. The standard also includes the treatment of cur-

rent assets. In a global group like the Volvo Group, processes are continu-

ously ongoing regarding the sale of assets or groups of assets at minor

values. When the criteria for being classifi ed as a non-current asset held

for sale are fulfi lled and the asset or group of assets are of signifi cant

value, the asset or group of assets and the related liabilities are recognized

on a separate line in the balance sheet. The asset or group of assets are

tested for impairment and, if impaired, measured at fair value after deduc-

tions for selling expenses. The balance sheet items and the income effect

resulting from the revaluation to fair value less selling expenses are nor-

mally recognized in the segment Group headquarter functions and other,

until the sale is completed and the result distributed to each segment.

AB Volvo’s holding of shares in subsidiaries as of December 31, 2013 is

disclosed in note 13 for the Parent Company. Signifi cant acquisitions,

formations and divestments within the Group are listed below.

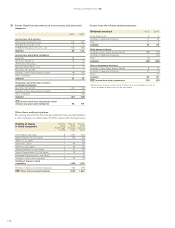

Business combinations during the period

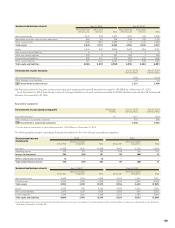

During 2013, the Volvo Group acquired net assets amounting to 23 (702).

The acquisition do not have any signifi cant impact on the Volvo Group’s

earnings and fi nancial position. For acquisitions made in 2012, the fair-

value adjustments to the acquisition balance sheets have not had any sig-

nifi cant impact on the Volvo Group. The impact on the Volvo Group’s bal-

ance sheet and cash-fl ow statement in connection with the acquisition of

subsidiaries and other business units are specifi ed in the following table.

Acquisitions 2013 2012

Intangible assets – 190

Property, plant and equipment 14 176

Assets under operating lease 8 475

Inventories 96 503

Current receivables 2 257

Cash and cash equivalents – 21

Other assets – 14

Minority interests – –

Provisions (1) (87)

Loans (1) (225)

Current liabilities (95) (622)

Acquired net assets 23 702

Goodwill 48 888

Negative goodwill – (42)

Total 71 1,548

Cash and cash equivalents paid (71) (1,548)

Cash and cash equivalents according to acquisition

analysis – 21

Effect on Group cash

and cash equivalents (71) (1,527)

Effect on Group net

fi nancial position (138) (1,714)

NOTE 3 ACQUISITIONS AND DIVESTMENTS OF SHARES IN SUBSIDIARIES

120

FINANCIAL INFORMATION 2013

120