Volvo 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated fi nancial statements

Principles for consolidation

The consolidated fi nancial statements are as from January 2013 pre-

pared in accordance with the principles set forth in IFRS 10 Consolidated

Financial Statements. Accordingly, intra-group transactions and gains on

transactions with joint ventures and associated companies are eliminated.

The consolidated fi nancial statements comprise the Parent Company, sub-

sidiaries, joint ventures and associated companies.

– Subsidiaries are defi ned as entities that are controlled by the Volvo Group.

– Joint ventures refer to joint arrangements whereby the Volvo Group to -

gether with one or more parties that have joint control, have rights to the

net assets of the arrangements. Joint ventures are as from January 1,

2013 recognized using the equity method of consolidation. Comparative

fi gures for 2012 have been restated.

– Associated companies are companies in which Volvo Group has a sig-

nifi cant infl uence, which is normally when Volvo Group’s holding of

shares correspond to at least 20% but less than 50% of the voting

rights. Holdings in associated companies are recognized in accordance

with the equity method.

Read more about how the changes in accounting principles for joint ventures

have affected the Volvo Group’s fi nancial reports in Note 31.

Translation to Swedish kronor when consolidating companies are using

foreign currencies

AB Volvo’s functional currency is Swedish krona (SEK). The functional

currency of each Volvo Group company is determined based on the pri-

mary economic environment in which it operates. The primary economic

environment is normally the one in which the company primarily generates

and expends cash. In most cases, the functional currency is the currency

of the country where the company is located. AB Volvo’s and the Volvo

Group’s presentation currency is SEK. In preparing the consolidated fi nan-

cial statements, items in the income statements of foreign subsidiaries

(except for subsidiaries in hyperinfl ationary economies) are translated to SEK

using monthly average exchange rates. Balance-sheet items are trans-

lated into SEK using exchange rates at year-end (closing rate). Exchange

differences arising, are recognized in other comprehensive income and

accumulated in equity.

The accumulated translation differencies related to a certain subsidi-

ary, joint venture or associated company are reversed to the income state-

ment as a part of the gain/loss arising from disposal of such a company

or repayment of capital contribution from such a company.

Receivables and liabilities in foreign currency

Receivables and liabilities in currencies other than the functional currency

(foreign currencies) are translated to the functional currency using the

closing rate. Translation differences on operating assets and liabilities are

recognized in operating income, while translation differences arising in

fi nancial assets and liabilities are recognized in fi nancial income and

expenses. Financial assets and liabilities are defi ned as items included in

the net fi nancial position of the Volvo Group (see Defi nitions at the end of

this report). Derivative fi nancial instruments used for hedging of exchange

and interest risks are recognized at fair value. Gains on exchange rates

are recognized as receivables and losses on exchange rates are recog-

nized as liabilities. Depending on the lifetime of the fi nancial instrument,

the item is recognized as current or non-current in the balance sheet.

Ex change rate differences on loans and other fi nancial instruments in

foreign currency, which are used to hedge net assets in foreign subsidiaries

and associated companies, are offset against translation differences in the

shareholders’ equity of the respective companies. Exchange-rate gains and

losses on assets and liabilities in foreign currencies, both on payments dur-

ing the year and on measurements at year-end, impact profi t or loss in the

year in which they are incurred. The more important exchange rates applied

in the consolidated fi nancial statements are shown in the table.

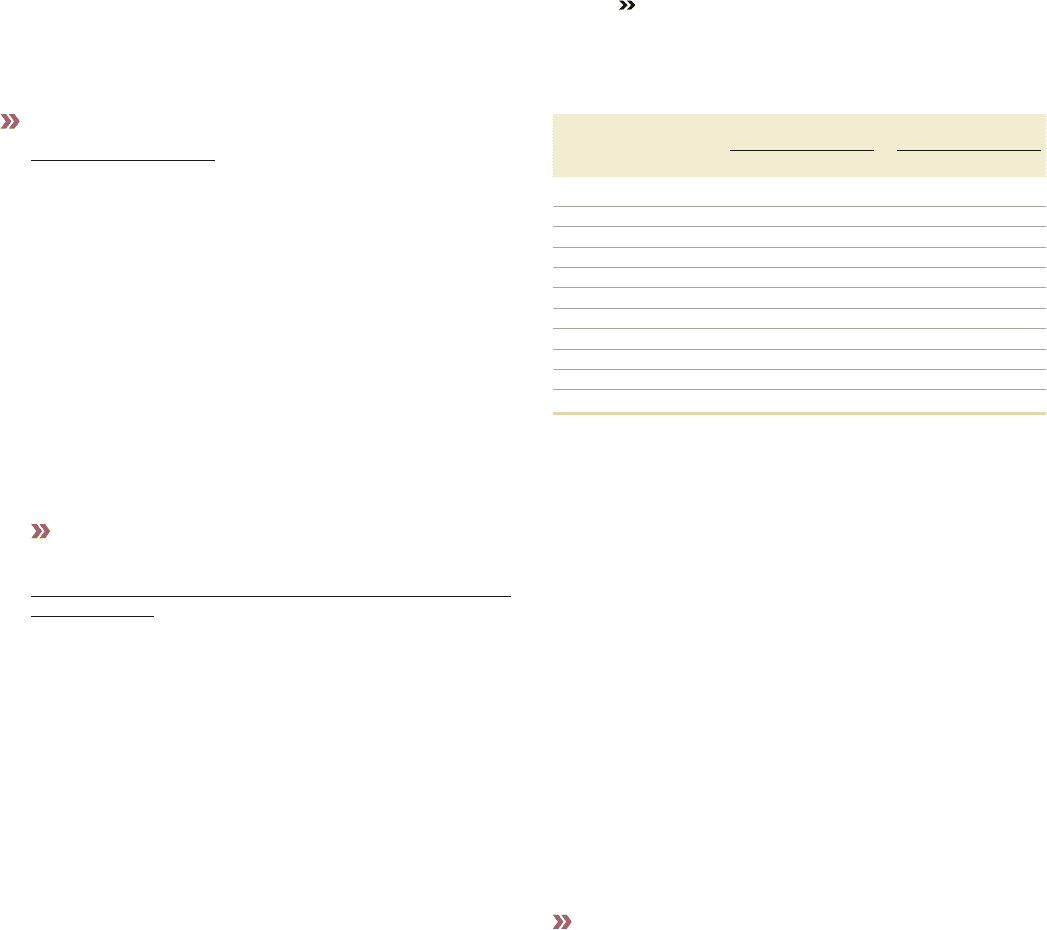

Exchange rates Average rate Closing rate

as of Dec 31

Country Currency 2013 2012 2013 2012

Australia AUD 6.3046 7.0183 5.7592 6.7655

Brazil BRL 3.0308 3.4837 2.7821 3.1885

Euro Zone EUR 8.6586 8.7145 8.9523 8.6259

Japan JPY 0.0669 0.0851 0.0619 0.0757

Canada CAD 6.3294 6.7827 6.0755 6.5536

China CNY 1.0573 1.0738 1.0732 1.0456

Norway NOK 1.1105 1.1651 1.0590 1.1682

Great Britain GBP 10.1926 10.7402 10.7392 10.4977

South Africa ZAR 0.6773 0.8275 0.6213 0.7661

South Korea KRW 0.0060 0.0060 0.0062 0.0061

United States USD 6.5153 6.7767 6.5097 6.5169

New accounting principles for 2013

As from January 1, 2013 the Volvo Group applies the following new account-

ing standards:

IFRS 10 Consolidated Financial Statements, IFRS 11 Joint Arrangements,

IFRS 12 Disclosure of Interests in Other Entities, amendments to IFRS 10,

IFRS 11 and IFRS 12, IFRS 13 Fair value Measurement, IAS 28 Investments

in Associates and joint ventures (revised 2011), amendments to IAS 1 Pres-

entation of Financial Statements, amendments to IAS 36 Impairment of

Assets, amendments to IFRS 7 Financial instruments: Disclosures and

IAS 19 Employee Benefi ts (revised 2011). The Volvo Group has also as from

January 1, 2013 changed the presentation regarding hedging effects on fi rm

fl ows to be included in the fi nance net, these were previously reported

within operating income. However hedging effects on fi rm fl ows from spe-

cifi c orders are still recognized in the operating income.

The major accounting changes refer to recognition of investments in

joint ventures in accordance with IFRS 11 and IAS 28 (revised), that the

Volvo Group ceases to account for defi ned pension liabilities using the so

called corridor method in accordance with IAS 19 (revised) and that the

presentation of hedging effects on commercial fl ows are changed to be

included in the fi nance net. The new accounting principles have been

applied retrospectively and comparative numbers for 2012, except for

cash-fl ow information, are restated and do not correspond to the numbers

presented in the Volvo Group Annual Report 2012.

Read more about the restatement and how IFRS 11 and IAS 28 (revised),

IAS19 (revised) and the changes in presentation of hedging have affected the

Volvo Group’s fi nancial reports in Note 31.

IFRS 10 Consolidated Financial Statements

IFRS 10 replaces the consolidation instructions in IAS 27 Consolidated

and Separate Financial Statements and SIC – 12 Consolidation – Special

Purpose Entities and introduce one basis for consolidation, which is control.

If the following three criteria are fulfi lled control is obtained (i) power of

the investee (ii) exposure, or rights, to variable returns from its involvement

with the investee, and (iii) the ability to use power over the investee to

affect the amount of the return. IFRS 10 has not had any signifi cant

impact on the consolidation of other companies of which the Volvo Group

has ownership or is involved.

IFRS 12 Disclosure of Interests in Other Entities

IFRS 12 requires more detailed disclosures on subsidiaries, joint arrange-

ments, associates and any unconsolidated structured entities in which the

company is involved. The disclosures in note 5 in the Volvo Group’s annual

report 2013 have to some extent increased due to IFRS 12. The disclosures

related to minority interests have also increased and are shown in note 11.

118

FINANCIAL INFORMATION 2013

118