Volvo 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198

|

|

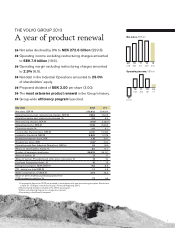

THE VOLVO GROUP 2013

A year of product renewal

Net sales declined by 9% to SEK 272.6 billion (299.8).

Operating income excluding restructuring charges amounted

to SEK 7.9 billion (19.6).

Operating margin excluding restructuring charges amounted

to 2.9% (6.5).

Net debt in the Industrial Operations amounted to 29.0%

of shareholders’ equity.

Proposed dividend of SEK 3.00 per share (3.00).

The most extensive product renewal in the Group’s history.

Group-wide effi ciency program launched.

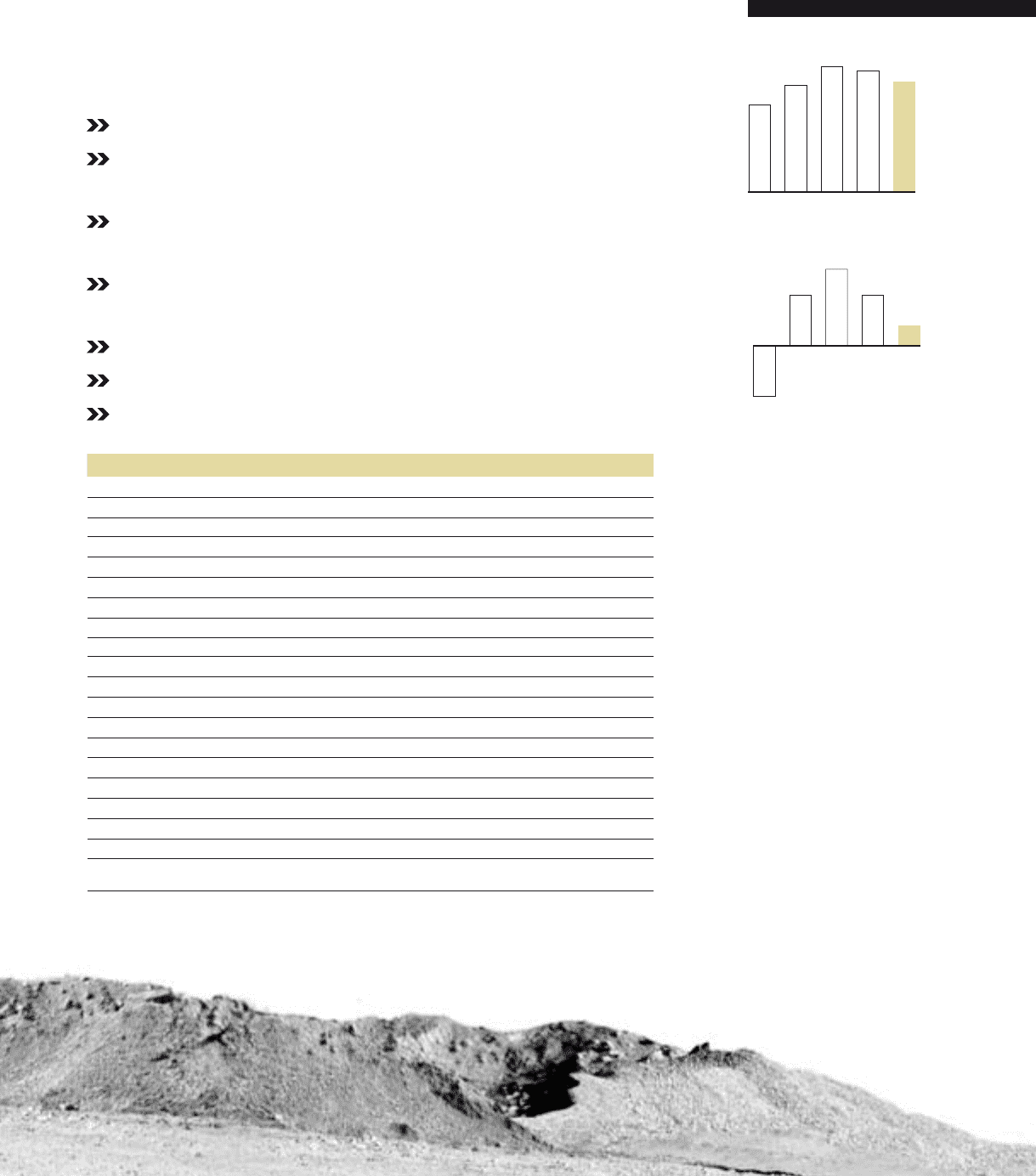

Net sales, SEK bn

1312111009

273300310265218

Operating income, SEK bn

1110

09

(17.0)

26.918.015.9

13

7.1

12

18.1

Key ratios 2013 20121

Net sales, SEK M 272,622 299,814

Operating income excl. restructuring charges, SEK M 7,85 4 19,619

Operating margin excl. restructuring charges, % 2.9 6.5

Restructuring charges,SEK M (715)2(1,550)2,3

Operating income, SEK M 7,138 18,069

Operating margin, % 2.6 6.0

Income after fi nancial items, SEK M 4,721 15,495

Income for the period, SEK M 3,802 11, 378

Diluted earnings per share, SEK 1.76 5.61

Dividend per share, SEK 3.0043.00

Operating cash fl ow, Industrial Operations, SEK bn 1.5 (4.9)

Return on shareholders’ equity, % 5.0 14.7

Number of permanent employees 95,533 96,137

Share of women, % 17 17

Share of women,Presidents and other senior executives, % 19 20

Employee Engagement Index, % 76 76

Energy consumption, MWh/SEK M 9.6 8.6

CO2 emissions, tons/SEK M 1.1 0.8

Water consumption, m3/SEK M 21.9 25.2

Share of direct material purchasing spend from

CSR assessed suppliers, % 72 66

1 Comparative fi gures for 2012 are restated in accordance with new accounting principles. Read more

in Note 31, Changes in the Volvo Group’s Financial Reporting 2013.

2 Restructuring charges included in the effi ciency program.

3 Other restructuring charges for comparison reasons.

4 According to the Board’s proposal.

1