Travelers 2011 Annual Report Download - page 97

Download and view the complete annual report

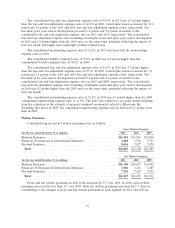

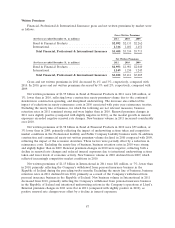

Please find page 97 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Earned premiums of $3.32 billion in 2010 were slightly lower than in 2009, primarily reflecting the

impact of intentional underwriting actions taken and competitive market conditions in the Professional

Liability business unit and in the Company’s operation at Lloyd’s. These factors were largely offset by

lower reinsurance costs, the impact of changes in the structure of the Company’s reinsurance during

the first quarter of 2010 that modestly increased retentions to directionally align retentions in the

Company’s International business with its U.S. practices, and the favorable impact of foreign currency

exchange rates.

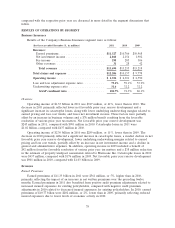

Net Investment Income

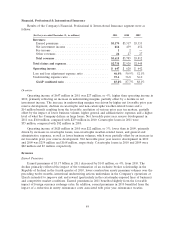

Net investment income of $414 million in 2011 decreased by $25 million, or 6%, compared with

2010. In 2010, net investment income of $439 million declined by $13 million, or 3%, from 2009.

Included in the Financial, Professional & International Insurance segment are certain legal entities

whose invested assets and related net investment income are reported exclusively in this segment and

not allocated among all business segments. As a result, reported net investment income in the

Financial, Professional & International Insurance segment reflects a significantly smaller proportion of

allocated net investment income, including that from the Company’s non-fixed maturity investments

that experienced a substantial increase in investment income in 2010. Refer to the ‘‘Net Investment

Income’’ section of ‘‘Consolidated Results of Operations’’ herein for a discussion of the change in the

Company’s consolidated net investment income in 2011 and 2010 as compared with the respective prior

years. In addition, refer to note 2 of notes to the Company’s consolidated financial statements for a

discussion of the Company’s net investment income allocation methodology.

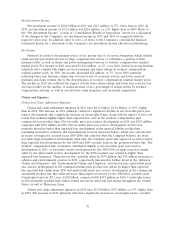

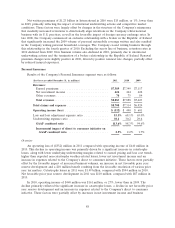

Claims and Expenses

Claims and Claim Adjustment Expenses

Claims and claim adjustment expenses in 2011 were $1.49 billion, $213 million, or 13%, lower than

in 2010, primarily reflecting an increase in net favorable prior year reserve development, a decline in

catastrophe losses, lower non-catastrophe weather-related losses and lower business volume, partially

offset by a higher level of large losses. Net favorable prior year reserve development was $360 million

and $259 million in 2011 and 2010, respectively. Both Bond & Financial Products and International

contributed to the net favorable prior year reserve development in 2011. In Bond & Financial Products,

net favorable development in 2011 primarily reflected better than expected results for accident years

2008 and prior for the contract surety business, and better than expected loss development for liability

lines of business, driven by the fiduciary product for accident years 2008 and prior. In International, net

favorable development in 2011 reflected better than expected loss development in Canada, primarily in

the surety, directors and officers, and general liability lines of business for recent accident years and

better than expected development in the Company’s operation at Lloyd’s in the aviation, kidnap &

ransom, and property lines for recent accident years. Catastrophe losses in 2011 were $55 million,

compared with $82 million in 2010. Catastrophe losses in 2011 included losses from floods in Thailand

and an earthquake in Japan. Catastrophe losses in 2010 primarily resulted from an earthquake in Chile.

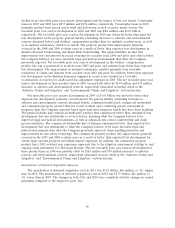

Claims and claim adjustment expenses in 2010 were $1.70 billion, $47 million, or 3%, lower than in

2009, primarily reflecting an increase in net favorable prior year reserve development, partially offset by

increases in catastrophe losses and non-catastrophe weather-related losses. In addition, the 2009 total

included an increase in reserves for a non-renewed professional liability program in the Republic of

Ireland. Net favorable prior year reserve development was $259 million and $168 million in 2010 and

2009, respectively. In Bond & Financial Products, net favorable prior year reserve development in 2010

was driven by better than expected loss development in the surety and management liability lines of

business due to lower than expected claim activity and loss severity in the 2008 and prior accident

years. In International, the majority of net favorable prior year reserve development in 2010 occurred

at the Company’s operation at Lloyd’s, in Canada and in the United Kingdom. Net favorable prior year

85