Travelers 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

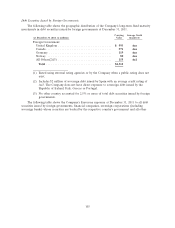

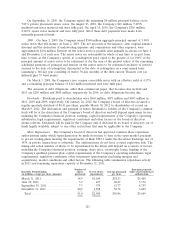

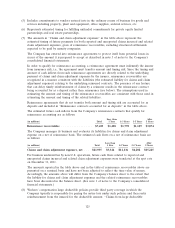

by structured settlements at December 31, 2011 (in millions). Also included is the A.M. Best rating of

the Company’s predominant insurer from each insurer group at February 16, 2012:

Structured

Group Settlements A.M. Best Rating of Group’s Predominant Insurer

Fidelity & Guaranty Life(1) .............. $1,007 B++ fifth highest of 16 ratings

MetLife ............................ 488 A+ second highest of 16 ratings

Genworth ........................... 449 A third highest of 16 ratings

Symetra ............................ 264 A third highest of 16 ratings

ING Group ......................... 222 A third highest of 16 ratings

(1) Fidelity & Guaranty Life was previously a subsidiary of Old Mutual U.S. Life Holdings, Inc. prior

to being sold by its U.K. parent company to Harbinger Group Inc. and being renamed.

Reinsurance companies and life insurance companies continued to be negatively impacted by

turbulent economic conditions, significant catastrophe events and investment portfolio challenges during

2011. A number of such companies have been subjected to downgrades and/or negative outlook

changes by various ratings agencies, including those with which the Company conducts business. The

Company considers these factors in assessing the adequacy of its allowance for uncollectible amounts.

OUTLOOK

The following discussion provides outlook information for certain key drivers of the Company’s

results of operations and capital position.

Premiums. The Company’s earned premiums are a function of net written premium volume. Net

written premiums comprise both renewal business and new business and are recognized as earned

premium over the life of the underlying policies. When business renews, the amount of net written

premiums associated with that business may increase or decrease (renewal premium change) as a result

of increases or decreases in rate and/or insured exposures, which the Company considers as a measure

of units of exposure. Net written premiums from both renewal and new business, and therefore earned

premiums, are impacted by competitive market conditions as well as general economic conditions,

which, particularly in the case of the Business Insurance segment, affect audit premium adjustments,

policy endorsements and mid-term cancellations. Net written premiums are also impacted by the

structure of reinsurance programs and related costs.

Given the possibility that more active weather patterns such as the Company experienced in 2011

and 2010 may continue, as well as the possibility that interest rates may remain low for some period of

time, along with the current level of profitability in certain of its product lines, the Company is

undertaking efforts to improve its underwriting margins. These efforts include seeking improved rates,

as well as improved terms and conditions on many of its insurance products, and may also include

other initiatives, such as reducing operating expenses and acquisition costs. These efforts may not be

successful and may result in lower retention and new business levels and therefore lower business

volumes. Nonetheless, the Company currently expects retention levels (the amount of expiring premium

that renews, before the impact of renewal premium changes) will remain strong relative to historical

experience. The Company also expects to continue to achieve renewal price increases during 2012. In

the Business Insurance segment, the Company expects a continued increase in renewal premium

changes, including increases in both of its components of rate changes and, subject to the economic

uncertainties described below, insured exposures, during 2012, compared with 2011. In the Financial,

Professional & International Insurance segment, the Company expects that renewal premium changes,

primarily due to the insured exposure component, will modestly improve during 2012 compared with

2011. In the Personal Insurance segment, the Company expects both Agency Automobile and Agency

Homeowners and Other renewal premium changes during 2012 will remain positive and will be slightly

higher than in 2011 based on the Company’s actions to file for rate increases. The need for state

115