Travelers 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

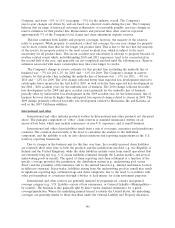

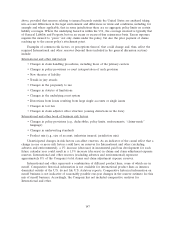

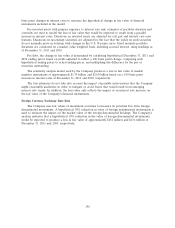

Reinsurance Recoverables

The following table summarizes the composition of the Company’s reinsurance recoverables:

(at December 31, in millions) 2011 2010

Gross reinsurance recoverables on paid and unpaid claims and

claim adjustment expenses ........................... $ 6,216 $ 6,934

Allowance for uncollectible reinsurance ................... (345) (363)

Net reinsurance recoverables .......................... 5,871 6,571

Mandatory pools and associations(1) ..................... 2,020 2,043

Structured settlements(2) ............................. 3,291 3,380

Total reinsurance recoverables ......................... $11,182 $11,994

(1) Includes impact from certain reclassifications made to 2010 amounts to conform to 2011

presentation.

(2) Included in the Company’s reinsurance recoverables are certain structured settlements

issued by Fidelity & Guaranty Life, which was previously a subsidiary of Old Mutual U.S.

Life Holdings, Inc. prior to being sold by its U.K. parent company to Harbinger

Group Inc. and being renamed.

The $700 million decline in net reinsurance recoverables since December 31, 2010 reflected cash

collections and the impact of net favorable prior year reserve development.

Amounts recoverable from reinsurers are estimated in a manner consistent with the associated

claim liability. The Company evaluates and monitors the financial condition of its reinsurers under

voluntary reinsurance arrangements to minimize its exposure to significant losses from reinsurer

insolvencies. In addition, in the ordinary course of business, the Company becomes involved in

coverage disputes with its reinsurers. Some of these disputes could result in lawsuits and arbitrations

brought by or against the reinsurers to determine the Company’s rights and obligations under the

various reinsurance agreements. The Company employs dedicated specialists and aggressive strategies

to manage reinsurance collections and disputes.

The reinsurance agreements that the Company entered into as part of its catastrophe bond

programs are dual trigger contracts and meet the requirements to be accounted for as reinsurance in

accordance with guidance for accounting for reinsurance contracts. The Company’s catastrophe bond

programs are described in more detail in ‘‘Item 1—Business—Catastrophe Reinsurance.’’

The Company reports its reinsurance recoverables net of an allowance for estimated uncollectible

reinsurance recoverables. The allowance is based upon the Company’s ongoing review of amounts

outstanding, length of collection periods, changes in reinsurer credit standing, disputes, applicable

coverage defenses and other relevant factors. Accordingly, the establishment of reinsurance

recoverables and the related allowance for uncollectible reinsurance recoverables is also an inherently

uncertain process involving estimates. From time to time, as a result of the long-tailed nature of the

underlying liabilities, coverage complexities and potential for disputes, the Company considers the

commutation of reinsurance contracts. Changes in estimated reinsurance recoverables and commutation

activity could result in additional income statement charges.

Recoverables attributable to structured settlements relate primarily to personal injury claims, of

which workers’ compensation claims comprise a significant portion, for which the Company has

purchased annuities and remains contingently liable in the event of a default by the companies issuing

the annuities. Recoverables attributable to mandatory pools and associations relate primarily to

workers’ compensation service business. These recoverables are supported by the participating

148