Travelers 2011 Annual Report Download - page 119

Download and view the complete annual report

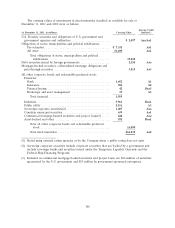

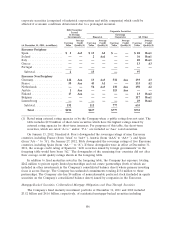

Please find page 119 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.pass-through-securities and collateralized mortgage obligations (CMO), all of which are subject to

prepayment risk (either shortening or lengthening of duration). While prepayment risk for both

guaranteed and non-guaranteed securities and its effect on income cannot be fully controlled,

particularly when interest rates move dramatically, the Company’s investment strategy generally favors

securities that control this risk within expected interest rate ranges. Included in the totals at

December 31, 2011 and 2010 were $1.82 billion and $2.09 billion, respectively, of GNMA, FNMA and

FHLMC (excluding FHA project loans) guaranteed residential mortgage-backed pass-through securities

classified as available for sale. Also included in those totals were residential CMOs classified as

available for sale with a fair value of $1.70 billion and $2.07 billion, at December 31, 2011 and 2010,

respectively.

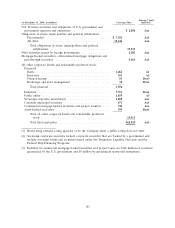

Approximately 38% of the Company’s CMO holdings were guaranteed by or fully collateralized by

securities issued by GNMA, FNMA or FHLMC at both December 31, 2011 and 2010. The average

credit rating of the $1.05 billion and $1.28 billion of non-guaranteed CMO holdings at December 31,

2011 and 2010, respectively, was ‘‘Ba1’’ and ‘‘Baa1,’’ respectively. The average credit rating of all of the

above securities was ‘‘Aa3’’ and ‘‘Aa1’’ at December 31, 2011 and 2010, respectively.

The Company makes investments in residential CMOs that are either guaranteed by GNMA,

FNMA or FHLMC, or if not guaranteed, are senior or super-senior positions within their respective

securitizations. Both guaranteed and non-guaranteed residential CMOs allocate the distribution of

payments from the underlying mortgages among different classes of bondholders. In addition,

non-guaranteed residential CMOs provide structures that allocate the impact of credit losses to

different classes of bondholders. Senior and super-senior CMOs are protected, to varying degrees, from

credit losses as those losses are initially allocated to subordinated bondholders. The Company’s

investment strategy is to purchase CMO tranches that are expected to offer the most favorable return

given the Company’s assessment of associated risks. The Company does not purchase residual interests

in CMOs.

Commercial Mortgage-Backed Securities and Project Loans

At December 31, 2011 and 2010, the Company held commercial mortgage-backed securities

(including FHA project loans) of $446 million and $549 million, respectively. The Company does not

believe this portfolio exposes it to a material adverse impact on its results of operations, financial

position or liquidity, due to the portfolio’s relatively small size and the underlying credit strength of

these securities.

Alternative Documentation Mortgages and Sub-Prime Mortgages

At December 31, 2011 and 2010, the ‘‘mortgage-backed securities, collateralized mortgage

obligations and pass-through securities’’ and ‘‘asset-backed and other’’ categories in the foregoing table

included collateralized mortgage obligations backed by alternative documentation mortgages and asset-

backed securities collateralized by sub-prime mortgages with a collective fair value of $351 million and

$297 million, respectively (comprising approximately 0.5% of the Company’s total fixed maturity

investments at both dates). The disruption in secondary investment markets provided the Company with

the opportunity to selectively acquire additional mortgage-backed securities at discounted prices. The

Company purchased $128 million and $31 million of such securities in the years ended December 31,

2011 and 2010, respectively. The Company defines sub-prime mortgage-backed securities as investments

in which the underlying loans primarily exhibit one or more of the following characteristics: low FICO

scores, above-prime interest rates, high loan-to-value ratios or high debt-to-income ratios. Alternative

documentation securitizations are those in which the underlying loans primarily meet the government-

sponsored entities’ requirements for credit score but do not meet the government-sponsored entities’

guidelines for documentation, property type, debt and loan-to-value ratios. The average credit rating on

these securities and obligations held by the Company was ‘‘Baa2’’ at both December 31, 2011 and 2010.

107