Travelers 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293

|

|

terrorism and financial loss due to business interruption resulting from covered property

damage. For additional information on terrorism coverages, see ‘‘Reinsurance—Catastrophe

Reinsurance—Terrorism Risk Insurance Acts.’’ Property also includes specialized equipment

insurance, which provides coverage for loss or damage resulting from the mechanical breakdown

of boilers and machinery, and ocean and inland marine insurance, which provides coverage for

goods in transit and unique, one-of-a-kind exposures.

•General Liability. Insures businesses against third-party claims arising from accidents occurring

on their premises or arising out of their operations, including as a result of injuries sustained

from products sold. Specialized liability policies may also include coverage for directors’ and

officers’ liability arising in their official capacities, employment practices liability insurance,

fiduciary liability for trustees and sponsors of pension, health and welfare, and other employee

benefit plans, errors and omissions insurance for employees, agents, professionals and others

arising from acts or failures to act under specified circumstances, as well as umbrella and excess

insurance.

•Commercial Multi-Peril. Provides a combination of the property and liability coverages

described in the foregoing product line descriptions.

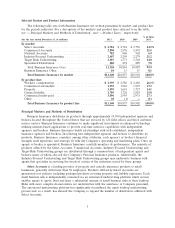

Net Retention Policy

The following discussion reflects the Company’s retention policy with respect to the Business

Insurance segment as of January 1, 2012. For third-party liability, Business Insurance generally limits its

net retention, through the use of reinsurance, to a maximum of $18.8 million per insured, per

occurrence after the Company retains an aggregate layer of expected losses. The net retained amount

per risk for property exposures is generally limited to $18.0 million, after reinsurance. The Company

generally retains its workers’ compensation exposures. Reinsurance treaties often have aggregate limits

or caps which may result in larger net per-risk retentions if the aggregate limits or caps are reached.

The Company utilizes facultative reinsurance to provide additional limits capacity or to reduce

retentions on an individual risk basis. The Company may also retain amounts greater than those

described herein based upon the individual characteristics of the risk.

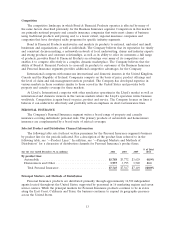

Geographic Distribution

The following table shows the geographic distribution of Business Insurance’s direct written

premiums for the states that accounted for the majority of premium volume for the year ended

December 31, 2011:

% of

State Total

California .................................................. 13.4%

New York ................................................. 7.7

Texas ..................................................... 7.4

Illinois .................................................... 4.9

Florida ................................................... 4.3

Pennsylvania ................................................ 4.2

New Jersey ................................................ 3.6

Massachusetts .............................................. 3.5

All others(1) ............................................... 51.0

Total ................................................... 100.0%

(1) No other single state accounted for 3.0% or more of the total direct written premiums

written in 2011 by the Business Insurance segment.

8