Travelers 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.U.S. field claim management teams located in 21 claim centers and 60 satellite and specialty-only

offices in 46 states are organized to maintain focus on the specific claim characteristics unique to the

businesses within the Company’s business segments. Claim teams with specialized skills, required

licenses, resources and workflows are matched to the unique exposures of those businesses, with local

claims management dedicated to achieving optimal results within each segment. The Company’s home

office operations provide additional support in the form of workflow design, quality management,

information technology, advanced management information and data analysis, training, financial

reporting and control, and human resources strategy. This structure permits the Company to maintain

the economies of scale of a large, established company while retaining the agility to respond promptly

to the needs of customers, brokers, agents and underwriters. Claims management for International is

generally provided locally by staff in the respective international locations due to local knowledge of

applicable laws and regulations, although it is also managed by the Company’s U.S. Claims Services

organization to leverage that knowledge base and to share best practices.

An integral part of the Company’s strategy to benefit customers and shareholders is its continuing

industry leadership in the fight against insurance fraud through its Investigative Services unit. The

Company has a nationwide staff of experts that investigate a wide array of insurance fraud schemes

using in-house forensic resources and other technological tools. This staff also has specialized expertise

in fire scene examinations, medical provider fraud schemes and data mining. The Company also

dedicates investigative resources to ensure that violations of law are reported to and prosecuted by law

enforcement agencies.

Claims Services uses technology, management information and data analysis to assist the Company

in reviewing its claim practices and results in order to evaluate and improve its claims management

performance. The Company’s claims management strategy is focused on segmentation of claims and

appropriate technical specialization to drive effective claim resolution. The Company continually

monitors its investment in claim resources to maintain an effective focus on claim outcomes and a

disciplined approach to continual improvement. The Company operates a state-of-the-art claims

training facility, offering hands-on experiential learning to help ensure that its claim professionals are

properly trained. In recent years, the Company has invested significant additional resources in many of

its claim handling operations and routinely monitors the effect of those investments to ensure a

consistent optimization among outcomes, cost and service.

In recent years, Claims Services refined its catastrophe response strategy to increase the

Company’s ability to respond to a significant catastrophic event using its own personnel, enabling it to

minimize reliance on independent adjustors and appraisers. The Company has developed a large

dedicated catastrophe response team and trained a large Enterprise Response Team of existing

employees who can be deployed on short notice in the event of a catastrophe that generates claim

volume exceeding the capacity of the dedicated catastrophe response team. In recent years, these

internal resources were successfully deployed to respond to a record number of catastrophe claims.

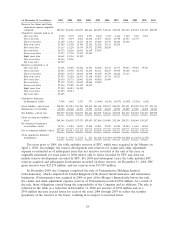

REINSURANCE

The Company reinsures a portion of the risks it underwrites in order to control its exposure to

losses. The Company cedes to reinsurers a portion of these risks and pays premiums based upon the

risk and exposure of the policies subject to such reinsurance. Ceded reinsurance involves credit risk,

except with regard to mandatory pools and associations, and is generally subject to aggregate loss

limits. Although the reinsurer is liable to the Company to the extent of the reinsurance ceded, the

Company remains liable as the direct insurer on all risks reinsured. Reinsurance recoverables are

reported after reductions for known insolvencies and after allowances for uncollectible amounts. The

Company also holds collateral, including trust agreements, escrow funds and letters of credit, under

certain reinsurance agreements. The Company monitors the financial condition of reinsurers on an

ongoing basis and reviews its reinsurance arrangements periodically. Reinsurers are selected based on

17