Travelers 2011 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

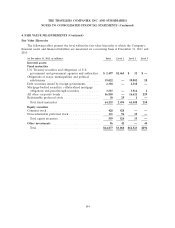

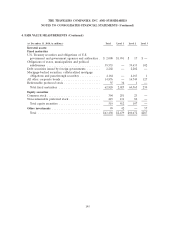

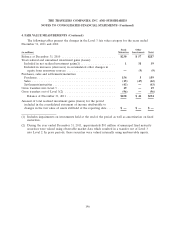

4. FAIR VALUE MEASUREMENTS (Continued)

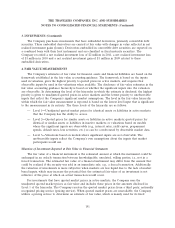

maturity investments. The fair value estimates provided from this pricing service are included in the

amount disclosed in Level 2 of the hierarchy. If quoted market prices and an estimate from a pricing

service are unavailable, the Company produces an estimate of fair value based on internally developed

valuation techniques, which, depending on the level of observable market inputs, will render the fair

value estimate as Level 2 or Level 3. The Company bases all of its estimates of fair value for assets on

the bid price as it represents what a third-party market participant would be willing to pay in an arm’s

length transaction.

Fixed Maturities

The Company utilizes a pricing service to estimate fair value measurements for approximately 98%

of its fixed maturities. The pricing service utilizes market quotations for fixed maturity securities that

have quoted prices in active markets. Since fixed maturities other than U.S. Treasury securities

generally do not trade on a daily basis, the pricing service prepares estimates of fair value

measurements for these securities using its proprietary pricing applications, which include available

relevant market information, benchmark curves, benchmarking of like securities, sector groupings and

matrix pricing. Additionally, the pricing service uses an Option Adjusted Spread model to develop

prepayment and interest rate scenarios.

The pricing service evaluates each asset class based on relevant market information, relevant credit

information, perceived market movements and sector news. The market inputs utilized in the pricing

evaluation, listed in the approximate order of priority, include: benchmark yields, reported trades,

broker/dealer quotes, issuer spreads, two-sided markets, benchmark securities, bids, offers, reference

data, and industry and economic events. The extent of the use of each market input depends on the

asset class and the market conditions. Depending on the security, the priority of the use of inputs may

change or some market inputs may not be relevant. For some securities, additional inputs may be

necessary.

The pricing service utilized by the Company has indicated that they will only produce an estimate

of fair value if there is objectively verifiable information to produce a valuation. If the pricing service

discontinues pricing an investment, the Company would be required to produce an estimate of fair

value using some of the same methodologies as the pricing service but would have to make

assumptions for market-based inputs that are unavailable due to market conditions.

The fair value estimates of most fixed maturity investments are based on observable market

information rather than market quotes. Accordingly, the estimates of fair value for such fixed

maturities, other than U.S. Treasury securities, provided by the pricing service are included in the

amount disclosed in Level 2 of the hierarchy. The estimated fair value of U.S. Treasury securities is

included in the amount disclosed in Level 1 as the estimates are based on unadjusted market prices.

The Company also holds certain fixed maturity investments which are not priced by the pricing

service and estimates the fair value of such fixed maturities using an internal matrix that is based on

market information regarding interest rates, credit spreads and liquidity. The underlying source data for

calculating the matrix of credit spreads relative to the U.S. Treasury curve are the BofA Merrill Lynch

U.S. Corporate Index and the BofA Merrill Lynch High Yield BB Rated Index. The Company includes

the fair value estimates of these corporate bonds in Level 2, since all significant inputs are market

observable.

192