Travelers 2011 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Competition

The competitive landscape in which Bond & Financial Products operates is affected by many of

the same factors described previously for the Business Insurance segment. Competitors in this market

are primarily national property and casualty insurance companies that write most classes of business

using traditional products and pricing and, to a lesser extent, regional insurance companies and

companies that have developed niche programs for specific industry segments.

Bond & Financial Products underwrites and markets its products to national, mid-sized and small

businesses and organizations, as well as individuals. The Company believes that its reputation for timely

and consistent decision making, a nationwide network of local underwriting, claims and industry experts

and strong producer and customer relationships, as well as its ability to offer its customers a full range

of products, provides Bond & Financial Products an advantage over many of its competitors and

enables it to compete effectively in a complex, dynamic marketplace. The Company believes that the

ability of Bond & Financial Products to cross-sell its products to customers of the Business Insurance

and Personal Insurance segments provides additional competitive advantages for the Company.

International competes with numerous international and domestic insurers in the United Kingdom,

Canada and the Republic of Ireland. Companies compete on the basis of price, product offerings and

the level of claim and risk management services provided. The Company has developed expertise in

various markets in these countries similar to those served in the United States and provides both

property and casualty coverage for these markets.

At Lloyd’s, International competes with other syndicates operating in the Lloyd’s market as well as

international and domestic insurers in the various markets where the Lloyd’s operation writes business

worldwide. Competition is again based on price, product and service. The Company focuses on lines it

believes it can underwrite effectively and profitably with an emphasis on short-tail insurance lines.

PERSONAL INSURANCE

The Company’s Personal Insurance segment writes a broad range of property and casualty

insurance covering individuals’ personal risks. The primary products of automobile and homeowners

insurance are complemented by a broad suite of related coverages.

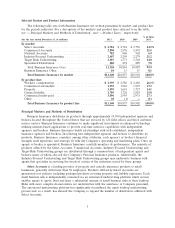

Selected Product and Distribution Channel Information

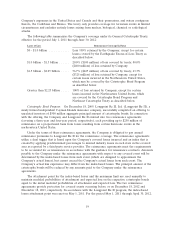

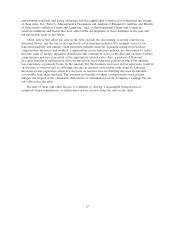

The following table sets forth net written premiums for the Personal Insurance segment’s business

by product line for the periods indicated. For a description of the product lines referred to in the

following table, see ‘‘—Product Lines.’’ In addition, see ‘‘—Principal Markets and Methods of

Distribution’’ for a discussion of distribution channels for Personal Insurance’s product lines.

% of Total

(for the year ended December 31, in millions) 2011 2010 2009 2011

By product line:

Automobile ...................................... $3,788 $3,772 $3,629 48.9%

Homeowners and Other ............................. 3,957 3,795 3,520 51.1

Total Personal Insurance ........................... $7,745 $7,567 $7,149 100.0%

Principal Markets and Methods of Distribution

Personal Insurance products are distributed primarily through approximately 12,500 independent

agents located throughout the United States, supported by personnel in 16 marketing regions and seven

service centers. While the principal markets for Personal Insurance products continue to be in states

along the East Coast, California and Texas, the business continues to expand its geographic presence

across the United States.

13