Travelers 2011 Annual Report Download - page 166

Download and view the complete annual report

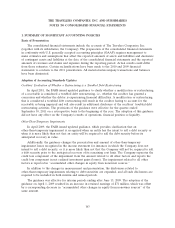

Please find page 166 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The carrying value of the Company’s investment portfolio at December 31, 2011 and 2010 was

$72.70 billion and $72.72 billion, respectively, of which 88% and 86% was invested in fixed maturity

securities, respectively. At December 31, 2011 and 2010, approximately 6.2% and 6.0%, respectively, of

the Company’s invested assets were denominated in foreign currencies. The Company’s exposure to

equity price risk is not significant. The Company has no direct commodity risk and is not a party to any

credit default swaps.

The primary market risks to the investment portfolio are interest rate risk and credit risk

associated with investments in fixed maturity securities. The portfolio duration relative to the liabilities’

duration is primarily managed through cash market transactions and treasury futures transactions.

At December 31, 2011 and 2010, the Company’s fixed maturity investment portfolio included

collateralized mortgage obligations backed by alternative documentation mortgages and asset-backed

securities collateralized by sub-prime mortgages with a collective fair value of $351 million and

$297 million, respectively (comprising approximately 0.5% of the Company’s total fixed maturity

investments at both dates). The disruption in secondary investment markets for mortgage-backed

securities provided the Company with the opportunity to selectively acquire additional asset-backed

securities collateralized by sub-prime mortgages at discounted prices. The Company purchased

$128 million and $31 million of such securities in 2011 and 2010, respectively. The Company defines

sub-prime mortgage-backed securities as investments in which the underlying loans primarily exhibit

one or more of the following characteristics: low FICO scores, above-prime interest rates, high

loan-to-value ratios or high debt-to-income ratios. Alternative documentation securitizations are those

in which the underlying loans primarily meet the government-sponsored entities’ requirements for

credit score but do not meet the government-sponsored entities’ guidelines for documentation, property

type, debt and loan-to-value ratios. The average credit rating on these securities and obligations held by

the Company was ‘‘Baa2’’ at both December 31, 2011 and 2010.

The Company’s fixed maturity investment portfolio at December 31, 2011 included securities issued

by numerous states, municipalities and political subdivisions (collectively referred to as the municipal

bond portfolio), a number of which were enhanced by third-party insurance for the payment of

principal and interest in the event of an issuer default. The downgrade of credit ratings of insurers of

these securities in recent years has resulted in a corresponding downgrade in the ratings of the

securities to the underlying rating of the respective security. Of the insured municipal securities in the

Company’s investment portfolio at December 31, 2011, approximately 99% were rated at A3 or above,

and approximately 92% were rated at Aa3 or above, without the benefit of insurance. The Company

believes that a loss of the benefit of insurance would not result in a material adverse impact on the

Company’s results of operations, financial position or liquidity, due to the underlying credit strength of

the issuers of the securities, as well as the Company’s ability and intent to hold the securities. The

average credit rating of the underlying issuers of these securities was ‘‘Aa2’’ at December 31, 2011. The

average credit rating of the entire municipal bond portfolio was ‘‘Aa1’’ at December 31, 2011 with and

without the third-party insurance.

On April 2, 2009, municipal securities issued by local governments within the United States were

assigned a negative outlook by Moody’s Investors Service. Notwithstanding the relatively low historical

rates of default on many of these obligations and notwithstanding that the Company typically seeks to

invest in high-credit-quality securities (including those with structural protections such as being secured

by dedicated or pledged sources of revenue), during or following an economic downturn, the

Company’s municipal bond portfolio could be subject to a higher risk of default or impairment due to

declining municipal tax bases and revenue. The severity and duration of state and local government

budget deficits could have an adverse impact on the collectability and valuation of the Company’s

municipal bond portfolio. In addition, some issuers may be unwilling to increase tax rates, or to reduce

spending, to fund interest or principal payments on their municipal bonds, or may be unable to access

the municipal bond market to fund such payments. The risk of widespread defaults may increase if

154