Travelers 2011 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

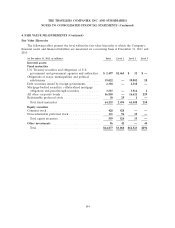

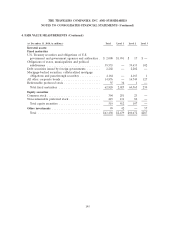

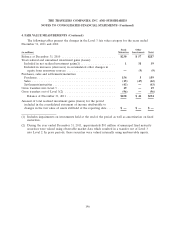

4. FAIR VALUE MEASUREMENTS (Continued)

Company produces an estimate of fair value based on internally developed valuation techniques which

are based on a discounted cash flow methodology and incorporates all available relevant observable

market inputs.

The fair value of commercial paper included in debt outstanding at December 31, 2011 and 2010

approximated its book value because of its short-term nature.

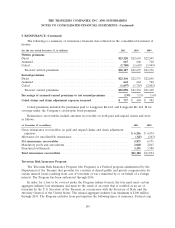

5. REINSURANCE

The Company’s consolidated financial statements reflect the effects of assumed and ceded

reinsurance transactions. Assumed reinsurance refers to the acceptance of certain insurance risks that

other insurance companies have underwritten. Ceded reinsurance involves transferring certain insurance

risks (along with the related written and earned premiums) the Company has underwritten to other

insurance companies who agree to share these risks. The primary purpose of ceded reinsurance is to

protect the Company, at a cost, from losses in excess of the amount it is prepared to accept.

Reinsurance is placed on both a quota-share and excess of loss basis. Ceded reinsurance arrangements

do not discharge the Company as the primary insurer, except for instances where the primary policy or

policies have been novated.

The Company utilizes general catastrophe reinsurance treaties with unaffiliated reinsurers to

manage its exposure to losses resulting from catastrophes. In addition to the coverage provided under

these treaties, the Company also utilizes a catastrophe bond program and a Northeast catastrophe

reinsurance treaty to protect against losses resulting from catastrophes in the Northeastern United

States. The Company also utilizes an excess-of-loss treaty in its National Property business unit of the

Business Insurance segment to protect against earthquake losses up to a certain threshold.

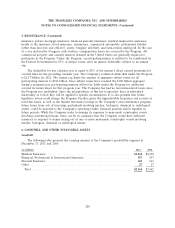

The Company evaluates and monitors the financial condition of its reinsurers under voluntary

reinsurance arrangements to minimize its exposure to significant losses from reinsurer insolvencies. In

addition, in the ordinary course of business, the Company may become involved in coverage disputes

with its reinsurers. Some of these disputes could result in lawsuits and arbitrations brought by or

against the reinsurers to determine the Company’s rights and obligations under the various reinsurance

agreements. The Company employs dedicated specialists and strategies to manage reinsurance

collections and disputes.

Included in reinsurance recoverables are certain amounts related to involuntary reinsurance

arrangements. The Company is required to participate in various involuntary reinsurance arrangements

through assumed reinsurance, principally with regard to residual market mechanisms in workers’

compensation and automobile insurance, as well as homeowners’ insurance in certain coastal areas. In

addition, the Company provides services for several of these involuntary arrangements (‘‘mandatory

pools and associations’’) under which it writes such residual market business directly, then cedes 100%

of this business to the mandatory pool. Such participations and servicing arrangements are arranged to

mitigate credit risk to the Company, as any ceded balances are jointly backed by all the pool members.

Also included in reinsurance recoverables are certain amounts related to structured settlements.

Structured settlements are annuities purchased from various life insurance companies to settle certain

personal physical injury claims, of which workers’ compensation claims comprise a significant portion.

In cases where the Company did not receive a release from the claimant, the structured settlement is

included in reinsurance recoverables as the Company retains the contingent liability to the claimant. In

the event that the life insurance company fails to make the required annuity payments, the Company

would be required to make such payments if and to the extent not paid by state guaranty associations.

198