Travelers 2011 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

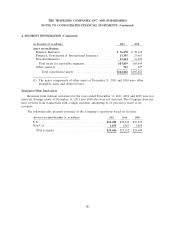

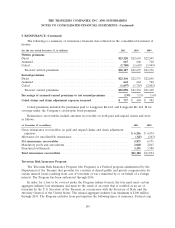

3. INVESTMENTS (Continued)

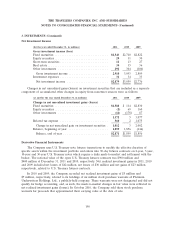

The Company purchases investments that have embedded derivatives, primarily convertible debt

securities. These embedded derivatives are carried at fair value with changes in value reflected in net

realized investment gains (losses). Derivatives embedded in convertible debt securities are reported on

a combined basis with their host instrument and are classified as fixed maturity securities. The

Company recorded a net realized investment loss of $2 million in 2011, a net realized investment loss

of $1 million in 2010 and a net realized investment gain of $1 million in 2009 related to these

embedded derivatives.

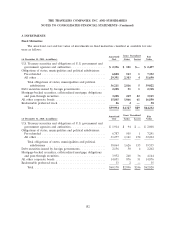

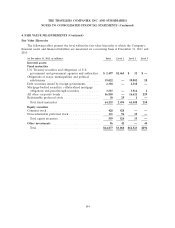

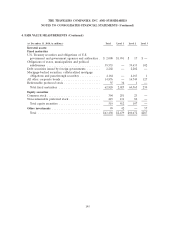

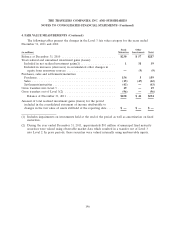

4. FAIR VALUE MEASUREMENTS

The Company’s estimates of fair value for financial assets and financial liabilities are based on the

framework established in the fair value accounting guidance. The framework is based on the inputs

used in valuation, gives the highest priority to quoted prices in active markets, and requires that

observable inputs be used in the valuations when available. The disclosure of fair value estimates in the

fair value accounting guidance hierarchy is based on whether the significant inputs into the valuation

are observable. In determining the level of the hierarchy in which the estimate is disclosed, the highest

priority is given to unadjusted quoted prices in active markets and the lowest priority to unobservable

inputs that reflect the Company’s significant market assumptions. The level in the fair value hierarchy

within which the fair value measurement is reported is based on the lowest level input that is significant

to the measurement in its entirety. The three levels of the hierarchy are as follows:

— Level 1—Unadjusted quoted market prices for identical assets or liabilities in active markets

that the Company has the ability to access.

— Level 2—Quoted prices for similar assets or liabilities in active markets; quoted prices for

identical or similar assets or liabilities in inactive markets; or valuations based on models

where the significant inputs are observable (e.g., interest rates, yield curves, prepayment

speeds, default rates, loss severities, etc.) or can be corroborated by observable market data.

— Level 3—Valuations based on models where significant inputs are not observable. The

unobservable inputs reflect the Company’s own assumptions about the inputs that market

participants would use.

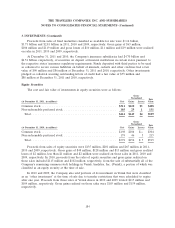

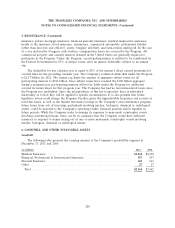

Valuation of Investments Reported at Fair Value in Financial Statements

The fair value of a financial instrument is the estimated amount at which the instrument could be

exchanged in an orderly transaction between knowledgeable, unrelated, willing parties, i.e., not in a

forced transaction. The estimated fair value of a financial instrument may differ from the amount that

could be realized if the security was sold in an immediate sale, e.g., a forced transaction. Additionally,

the valuation of investments is more subjective when markets are less liquid due to the lack of market

based inputs, which may increase the potential that the estimated fair value of an investment is not

reflective of the price at which an actual transaction would occur.

For investments that have quoted market prices in active markets, the Company uses the

unadjusted quoted market prices as fair value and includes these prices in the amounts disclosed in

Level 1 of the hierarchy. The Company receives the quoted market prices from a third party, nationally

recognized pricing service (pricing service). When quoted market prices are unavailable, the Company

utilizes a pricing service to determine an estimate of fair value, which is mainly used for its fixed

191