Travelers 2011 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

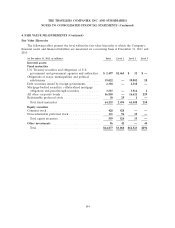

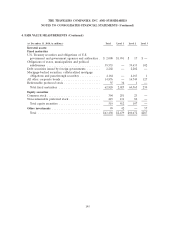

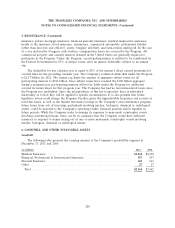

4. FAIR VALUE MEASUREMENTS (Continued)

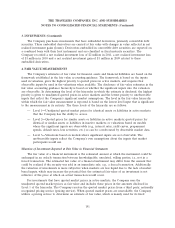

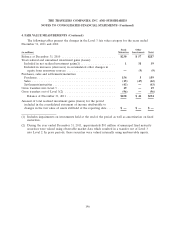

While the vast majority of the Company’s municipal bonds are included in Level 2, the Company

holds a small number of municipal bonds which are not valued by the pricing service and estimates the

fair value of these bonds using an internal pricing matrix with some unobservable inputs that are

significant to the valuation. Due to the limited amount of observable market information, the Company

includes the fair value estimates for these particular bonds in Level 3. Additionally, the Company holds

a small amount of other fixed maturity investments that have characteristics that make them unsuitable

for matrix pricing. For these fixed maturities, the Company obtains a quote from a broker (typically a

market maker). Due to the disclaimers on the quotes that indicate that the price is indicative only, the

Company includes these fair value estimates in Level 3.

Equities—Public Common and Preferred

For public common and preferred stocks, the Company receives prices from a nationally

recognized pricing service that are based on observable market transactions and includes these

estimates in the amount disclosed in Level 1. Infrequently, current market quotes in active markets are

unavailable for certain non-redeemable preferred stocks held by the Company. In these instances, the

Company receives an estimate of fair value from the pricing service that provides fair value estimates

for the Company’s fixed maturities. The service utilizes some of the same methodologies to price the

non-redeemable preferred stocks as it does for the fixed maturities. The Company includes the fair

value estimate for these non-redeemable preferred stocks in the amount disclosed in Level 2.

At December 31, 2010, the estimated fair value of stocks having transfer restrictions that expired

within one year was determined by adjusting the observed market price of the securities for a liquidity

discount which takes into consideration the restrictions that existed at December 31, 2010 and was

based on market observable inputs. As a result of adjusting the market price to reflect the impact of

the transfer restrictions on estimated fair value, the Company disclosed these holdings in Level 2 at

December 31, 2010. At December 31, 2011, the Company held no stocks having transfer restrictions

that expired within one year.

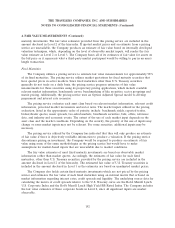

Other Investments

The Company holds investments in various publicly-traded securities which are reported in other

investments. These investments include securities in the Company’s trading portfolio, mutual funds and

other small holdings. The $42 million fair value of these investments at both December 31, 2011 and

2010 was disclosed in Level 1. At December 31, 2011 and 2010, the Company held investments in

non-public common and preferred equity securities, with fair value estimates of $44 million and

$57 million, respectively, reported in other investments, where the fair value estimate is determined

either internally or by an external fund manager based on recent filings, operating results, balance

sheet stability, growth and other business and market sector fundamentals. Due to the significant

unobservable inputs in these valuations, the Company includes the total fair value estimate for all of

these investments at December 31, 2011 and 2010 in the amount disclosed in Level 3.

Derivatives

At December 31, 2011 and 2010, the Company held $22 million and $37 million, respectively, of

convertible bonds containing embedded conversion options that are valued separately from the host

bond contract in the amount disclosed in Level 2—fixed maturities.

193