Travelers 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293

|

|

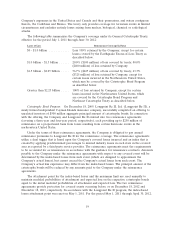

Company’s exposures in the United States and Canada and their possessions, and waters contiguous

thereto, the Caribbean and Mexico. The treaty only provides coverage for terrorism events in limited

circumstances and excludes entirely losses arising from nuclear, biological, chemical or radiological

attacks.

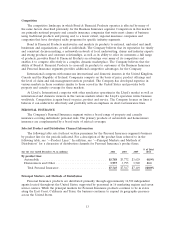

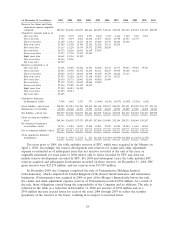

The following table summarizes the Company’s coverage under its General Catastrophe Treaty,

effective for the period July 1, 2011 through June 30, 2012:

Layer of Loss Reinsurance Coverage In-Force

$0 - $1.0 billion ............ Loss 100% retained by the Company, except for certain

losses covered by the Earthquake Excess-of-Loss Treaty as

described below.

$1.0 billion - $1.5 billion ...... 20.0% ($100 million) of loss covered by treaty; 80.0%

($400 million) of loss retained by Company.

$1.5 billion - $2.25 billion ..... 56.7% ($425 million) of loss covered by treaty; 43.3%

($325 million) of loss retained by Company, except for

certain losses incurred in the Northeastern United States,

which may be covered by the Catastrophe Bond Program

as described below.

Greater than $2.25 billion ..... 100% of loss retained by Company, except for certain

losses incurred in the Northeastern United States, which

are covered by the Catastrophe Bond Program and

Northeast Catastrophe Treaty as described below.

Catastrophe Bond Program. On December 18, 2009, Longpoint Re II, Ltd. (Longpoint Re II), a

newly formed independent Cayman Islands insurance company, successfully completed an offering to

unrelated investors of $500 million aggregate principal amount of catastrophe bonds. In connection

with the offering, the Company and Longpoint Re II entered into two reinsurance agreements

(covering a three-year and four-year period, respectively), each providing up to $250 million of

reinsurance on a proportional basis from losses resulting from certain hurricane events in the

northeastern United States.

Under the terms of these reinsurance agreements, the Company is obligated to pay annual

reinsurance premiums to Longpoint Re II for the reinsurance coverage. The reinsurance agreements

utilize a dual trigger that is based upon the Company’s covered losses incurred and an index that is

created by applying predetermined percentages to insured industry losses in each state in the covered

area as reported by a third-party service provider. The reinsurance agreements meet the requirements

to be accounted for as reinsurance in accordance with the guidance for reinsurance contracts. Amounts

payable to the Company under the reinsurance agreements with respect to any covered event will be

determined by the index-based losses from such event (which are designed to approximate the

Company’s actual losses), but cannot exceed the Company’s actual losses from such event. The

Company’s actual loss experience may differ from the index-based losses. The principal amount of the

catastrophe bonds will be reduced by any amounts paid to the Company under the reinsurance

agreements.

The attachment point for the index-based losses and the maximum limit are reset annually to

maintain modeled probabilities of attachment and expected loss on the respective catastrophe bonds

equal to the initial modeled probabilities of attachment and expected loss. The two reinsurance

agreements provide protection for covered events occurring before or on December 18, 2012 and

December 18, 2013, respectively. In accordance with the Longpoint Re II program, the index-based

losses attachment point was reset on May 1, 2011. For the period May 1, 2011 through April 30, 2012,

19