Travelers 2011 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

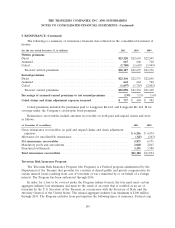

7. INSURANCE CLAIM RESERVES (Continued)

Company’s operation at Lloyd’s in the aviation, kidnap & ransom, and property lines for recent

accident years.

Personal Insurance. Net favorable prior year reserve development in 2011 was $110 million, driven

by better than expected loss development related to catastrophe losses incurred in the first half of 2010,

as well as better than expected loss development in the 2006-2010 accident years for the umbrella line

of business in the Homeowners and Other product line, partially offset by unfavorable prior year

reserve development in the Automobile product line that was driven by worse than expected loss

experience for the 2007-2010 accident years.

2010.

In 2010, estimated claims and claim adjustment expenses incurred included $1.42 billion of net

favorable development for claims arising in prior years, including $1.25 billion of net favorable prior

year reserve development impacting the Company’s results of operations, which excludes $45 million of

accretion of discount.

Business Insurance. Net favorable prior year reserve development in 2010 totaled $901 million,

driven by better than expected loss development in the property, general liability (excluding increases to

asbestos and environmental reserves discussed below) and workers’ compensation product lines for

multiple accident years, as well as in assumed reinsurance, which is in runoff. The property product line

improvement primarily occurred in the 2008 and 2009 accident years as a result of better than expected

loss development in Industry-Focused Underwriting and Target Risk Underwriting. The general liability

product line improvement was concentrated in excess coverages for accident years 2006 and prior and

reflected what the Company believes are more favorable legal and judicial environments than what the

Company previously expected. Net favorable prior year reserve development in the workers’

compensation product line was concentrated in accident years 2007 and prior and resulted from better

than expected loss development. The improvement in assumed reinsurance resulted primarily from

favorable resolutions of claims and disputes from accident years 2002 and prior. In addition, better than

expected loss development in the Business Insurance segment in recent years resulted in a favorable

re-estimation of reserves for unallocated loss adjustment expenses in 2010. The net favorable prior year

reserve development in these product lines in 2010 was partially offset by $140 million and $35 million

increases to asbestos and environmental reserves, respectively.

Financial, Professional & International Insurance. Net favorable prior year reserve development

totaled $259 million in 2010. In Bond & Financial Products, net favorable prior year reserve

development in 2010 was driven by better than expected loss development in the surety and

management liability lines of business due to lower than expected claim activity and loss severity in the

2008 and prior accident years. In International, the majority of net favorable prior year reserve

development in 2010 occurred at the Company’s operation at Lloyd’s, in Canada and in the United

Kingdom.

Personal Insurance. Net favorable prior year reserve development of $87 million in 2010 was

concentrated in the Homeowners and Other product line, primarily driven by favorable loss

development in the 2008 and prior accident years, primarily for the umbrella line of business, partially

offset by unfavorable loss development in the 2009 accident year for the homeowners line of business

that was driven by higher than anticipated late-reported claims related to storms in 2009.

204