Travelers 2011 Annual Report Download - page 139

Download and view the complete annual report

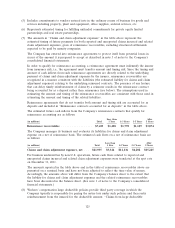

Please find page 139 of the 2011 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The insurance holding company laws of other states in which the Company’s subsidiaries are

domiciled generally contain similar, although in some instances somewhat more restrictive, limitations

on the payment of dividends. A maximum of $1.96 billion is available by the end of 2012 for such

dividends without prior approval of the Connecticut Insurance Department. The Company may choose

to accelerate the timing within 2012 and/or increase the amount of dividends from its insurance

subsidiaries in 2012, which could result in certain dividends being subject to approval by the

Connecticut Insurance Department. The holding company received $2.33 billion of dividends from its

domestic insurance subsidiaries in 2011.

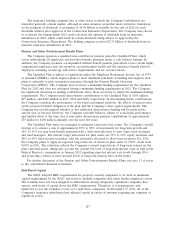

Pension and Other Postretirement Benefit Plans

The Company sponsors a qualified non-contributory pension plan (the Qualified Plan), which

covers substantially all employees and provides benefits primarily under a cash balance formula. In

addition, the Company sponsors a nonqualified defined benefit pension plan which covers certain highly

compensated employees and also sponsors a postretirement health and life insurance benefit plan for

employees satisfying certain age and service requirements and for certain retirees.

The Qualified Plan is subject to regulations under the Employee Retirement Income Act of 1974

as amended (ERISA), which requires plans to meet minimum standards of funding and requires such

plans to subscribe to plan termination insurance through the Pension Benefit Guaranty

Corporation (PBGC). The Company does not have a minimum funding requirement for the Qualified

Plan for 2012 and does not anticipate having a minimum funding requirement in 2013. The Company

has significant discretion in making contributions above those necessary to satisfy the minimum funding

requirements. The Company made discretionary contributions to the Qualified Plan of $185 million,

$35 million, and $260 million in 2011, 2010 and 2009, respectively. In determining future contributions,

the Company considers the performance of the plan’s investment portfolio, the effects of interest rates

on the projected benefit obligation of the plan and the Company’s other capital requirements. The

Company has not determined whether or not additional discretionary funding will be made in the

current year or beyond. However, the Company currently believes, subject to actual plan performance

and funded status at the time, that it may make discretionary pension contributions of approximately

$75 million to $100 million annually over the next few years.

The Qualified Plan assets are managed to maximize long-term total return. The Company’s overall

strategy is to achieve a mix of approximately 85% to 90% of investments for long-term growth and

10% to 15% for near-term benefit payments with a wide diversification of asset types, fund strategies

and fund managers. The current target allocations for plan assets are 55% to 65% equity securities and

20% to 40% fixed income securities, with the remainder allocated to short-term securities. For 2012,

the Company plans to apply an expected long-term rate of return on plan assets of 7.50%, down from

8.00% in 2011. The reduction reflects the Company’s current expectations of long-term returns on the

plan’s invested assets, taking into account the current low level of long-term interest rates as well as the

Federal Reserve’s commentary in January 2012 regarding expected interest rate levels through 2014,

and projecting a return to more normal levels of long-term interest rates in the future.

For further discussion of the Pension and Other Postretirement Benefit Plans, see note 13 of notes

to the consolidated financial statements.

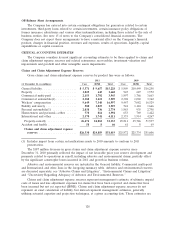

Risk-Based Capital

The NAIC adopted RBC requirements for property casualty companies to be used as minimum

capital requirements by the NAIC and states to identify companies that merit further regulatory action.

The formulas have not been designed to differentiate among adequately capitalized companies that

operate with levels of capital above the RBC requirements. Therefore, it is inappropriate and

ineffective to use the formulas to rate or to rank these companies. At December 31, 2011, all of the

Company’s insurance subsidiaries had adjusted capital in excess of amounts requiring any company or

regulatory action.

127