Sallie Mae 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

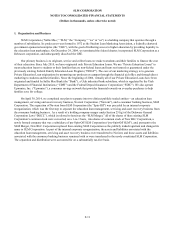

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

2.

Significant Accounting Policies (Continued)

Education Loans and two years for FFELP Loans. A loss confirmation period represents the expected period between a loss

event and when management considers the debt to be uncollectible, taking into consideration account management practices

that affect the timing of a loss, such as the usage of forbearance. The loss confirmation period underlying the allowance for loan

losses is subject to a number of assumptions. If actual future performance in delinquency, charge-offs and recoveries are

significantly different than estimated, or account management assumptions or practices were to change, this could materially

affect the estimate of the allowance for loan losses, the timing of when losses are recognized, and the related provision for loan

losses on our consolidated statements of income.

Below we describe in further detail our policies and procedures for the allowance for loan losses as they relate to our

Private Education Loan and FFELP Loan portfolios.

Allowance for Private Education Loan Losses

We maintain an allowance for loan losses at an amount sufficient to absorb probable losses incurred in our portfolios at

the reporting date based on a projection of estimated probable credit losses incurred in the portfolio.

In determining the allowance for loan losses on our Private Education Loan non-troubled debt restructuring (“TDR”)

portfolio, we estimate the principal amount of loans that will default over the next year (one year being the expected period

between a loss event and default) and how much we expect to recover over the same one year period related to the defaulted

amount. The expected defaults less our expected recoveries adjusted for any qualitative factors (discussed below) equal the

allowance related to this portfolio. Our historical experience indicates that, on average, the time between the date that a

customer experiences a default causing event (i.e., the loss trigger event) and the date that we charge off the unrecoverable

portion of that loan is one year.

In estimating both the non-TDR and TDR allowance amounts, we start with historical experience of customer

delinquency and default behavior. We make judgments about which historical period to start with and then make further

judgments about whether that historical experience is representative of future expectations and whether additional adjustments

may be needed to those historical default rates. We may also take certain other qualitative factors into consideration when

calculating the allowance for loan losses. These qualitative factors include, but are not limited to, changes in the economic

environment, changes in lending policies and procedures, including changes in underwriting standards and collection, charge-

off and recovery practices not already included in the analysis, and the effect of other external factors such as legal and

regulatory requirements on the level of estimated credit losses.

Our non-TDR allowance for loan losses is estimated using an analysis of delinquent and current accounts. Our model is

used to estimate the likelihood that a loan receivable may progress through the various delinquency stages and ultimately

charge off (“migration analysis”). Once a charge-off forecast is estimated, a recovery assumption is layered on top. In

estimating recoveries, we use both estimates of what we would receive from the sale of delinquent loans as well as historical

borrower payment behavior to estimate the timing and amount of future recoveries on charged-off loans.

The migration analysis model is based upon sixteen months of actual collection experience, which includes seven months

of collection experience using the 212 day charge-off default aversion strategies and nine months of experience using the 120

day charge-off default aversion strategies. We only used collection data from the first four collection buckets for all sixteen

months. This resulted in our inclusion of older periods when the accounts were not being aggressively collected in the 30 to

120 days delinquent buckets. We believe this is appropriate as we have very limited data since the change in collection

practices to be confident that the positive trends will continue. Once the quantitative calculation is performed, we review the

adequacy of the allowance for loan losses and determine if qualitative adjustments need to be considered.

Prior to the Spin-Off, the Bank exercised its right and sold substantially all of the Private Education Loans it originated

that became delinquent or were granted forbearance to an entity that is now a subsidiary of Navient at its fair value. Because of

this arrangement, the Bank did not hold many loans in forbearance. As a result, the Bank had very little historical forbearance

activity and very few delinquencies.

In connection with the Spin-Off, the agreement under which the Bank previously made these sales was amended so that

the Bank now only has the right to require Navient to purchase (at fair value) loans only where (a) the borrower has a lending

relationship with both the Bank and Navient (“Split Loans”) and (b) the Split Loans either (1) are more than 90 days past due;

F-14