Sallie Mae 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

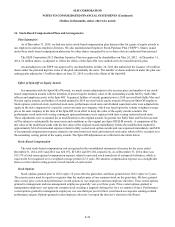

16. Arrangements with Navient Corporation

In connection with the Spin-Off, the Company entered into a separation and distribution agreement with Navient (the

“Separation and Distribution Agreement”). In connection therewith, the Company also entered into various other ancillary

agreements with Navient to effect the Spin-Off and provide a framework for its relationship with Navient thereafter, such as a

transition services agreement, a tax sharing agreement, an employee matters agreement, a loan servicing and administration

agreement, a joint marketing agreement, a key services agreement, a data sharing agreement and a master sublease agreement.

The majority of these agreements are transitional in nature with most having terms of two years or less from the date of the

Spin-Off.

We continue to have significant exposures to risks related to Navient’s loan originations and its creditworthiness. If we

are unable to obtain services, complete the transition of our origination operations as planned, or obtain indemnification

payments from Navient, we could experience higher than expected costs and operating expenses and our results of operations

and financial condition could be materially and adversely affected.

We briefly summarize below some of the most significant agreements and relationships we continue to have with

Navient. For additional information regarding the Separation and Distribution Agreement and the other ancillary agreements,

see our Current Report on Form 8-K filed on May 2, 2014.

Separation and Distribution Agreement

The Separation and Distribution Agreement addresses, among other things, the following ongoing activities:

• the obligation of each party to indemnify the other against liabilities retained or assumed by that party pursuant to the

Separation and the Distribution Agreement and in connection with claims of third parties;

• the allocation among the parties of rights and obligations under insurance policies;

• the agreement of the Company and Navient (i) not to engage in certain competitive business activities for a period of

five years, (ii) as to the effect of the non-competition provisions on post-spin merger and acquisition activities of the

parties and (iii) regarding “first look” opportunities; and

• the creation of a governance structure, including a separation oversight committee of representatives from the

Company and Navient, by which matters related to the separation and other transactions contemplated by the

separation and distribution agreement will be monitored and managed.

Transition Services

During a transition period, Navient and its affiliates provided the Bank with significant servicing capabilities with respect

to Private Education Loans held by the Company and its subsidiaries. On October 13, 2014, we transitioned the Private

Education Loan servicing to our own platform. The last remaining significant operational transition left to be completed is the

transition of the loan origination function. We anticipate the completion of this transition to occur in the first half of 2015.

Beyond this transition period, it is currently anticipated that Navient will continue to service Private Education Loans owned by

the Company or its subsidiaries with respect to individual borrowers who also have Private Education Loans which are owned

by Navient, in order to optimize the customer’s experience. In addition, Navient will continue to service and collect the Bank’s

portfolio of FFELP Loans indefinitely.

Indemnification Obligations

Navient has also agreed to be responsible, and indemnify us, for all claims, actions, damages, losses or expenses that may

arise from the conduct of all activities of pre-Spin-Off SLM occurring prior to the Spin-Off other than those specifically

excluded in the Separation and Distribution Agreement. Some significant examples of the types of indemnification obligations

Navient has under the Separation and Distribution Agreement and related ancillary agreements include:

F-50