Sallie Mae 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

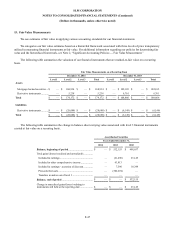

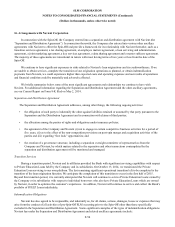

15. Fair Value Measurements

We use estimates of fair value in applying various accounting standards for our financial statements.

We categorize our fair value estimates based on a hierarchal framework associated with three levels of price transparency

utilized in measuring financial instruments at fair value. For additional information regarding our policies for determining fair

value and the hierarchical framework, see Note 2, “Significant Accounting Policies — Fair Value Measurement.”

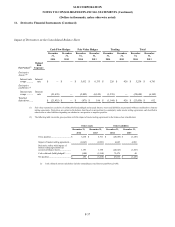

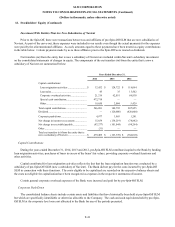

The following table summarizes the valuation of our financial instruments that are marked-to-fair value on a recurring

basis.

Fair Va l ue Measurements on a Recurring Basis

December 31, 2014

December 31, 2013

Level 1

Level 2

Level 3

Total

Level 1

Level 2

Level 3

Total

Assets

Mortgage-backed securities ....

$

—

$

168,934

$

—

$

168,934

$

—

$

102,105

$

—

$

102,105

Derivative instruments ...........

—

5,238

—

5,238

—

6,761

—

6,761

Total

$

—

$

174,172

$

—

$

174,172

$

—

$

108,866

$

—

$

108,866

Liabilities

Derivative instruments ...........

$

—

$

(28,688

)

$

—

$

(28,688

)

$

—

$

(6,149

)

$

—

$

(6,149

)

Total

$

—

$

(28,688

)

$

—

$

(28,688

)

$

—

$

(6,149

)

$

—

$

(6,149

)

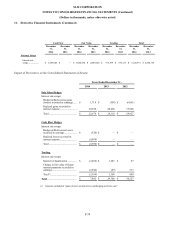

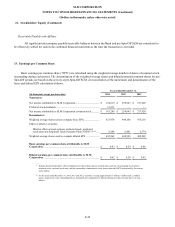

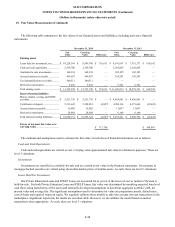

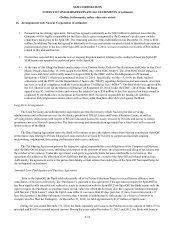

The following table summarizes the change in balance sheet carrying value associated with level 3 financial instruments

carried at fair value on a recurring basis.

Asset-Backed Securities

Years Ended December 31,

2014

2013

2012

Balance, beginning of period ..................................

$

—

$

532,155

$

498,657

Total gains/(losses) (realized and unrealized):.............

Included in earnings ..............................................

—

(21,490

)

23,149

Included in other comprehensive income .................

—

63,813

—

Included in earnings - accretion of discount .............

—

7,596

10,349

Proceeds from sale ................................................

—

(582,074

)

—

Transfers in and/or out of level 3 ............................

—

—

—

Balance, end of period ...........................................

$

—

$

—

$

532,155

Change in unrealized gains/(losses) relating to

instruments still held at the reporting date ..................

$

—

$

—

$

23,149

F-47