Sallie Mae 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

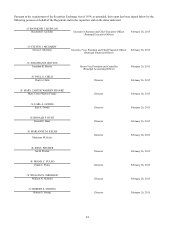

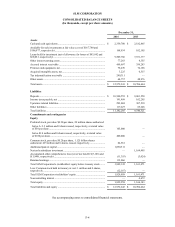

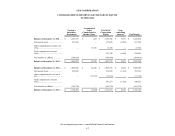

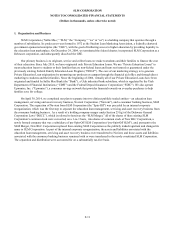

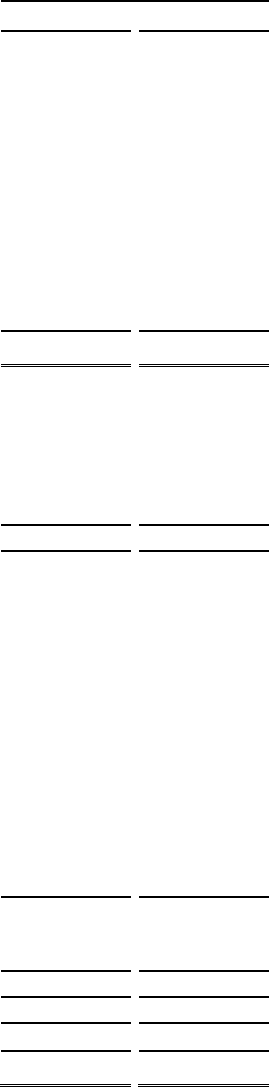

SLM CORPORATION

CONSOLIDATED BALANCE SHEETS

(In thousands, except per share amounts)

December 31,

2014

2013

Assets

Cash and cash equivalents ..................................................................

$

2,359,780

$

2,182,865

Available-for-sale investments at fair value (cost of $167,740 and

$106,977, respectively) ......................................................................

168,934

102,105

Loans held for investment (net of allowance for losses of $83,842 and

$68,081, respectively) ........................................................................

9,509,786

7,931,377

Other interest-earning assets ...............................................................

77,283

4,355

Accrued interest receivable ................................................................

469,697

356,283

Premises and equipment, net ..............................................................

78,470

74,188

Acquired intangible assets, net ............................................................

3,225

6,515

Tax indemnification receivable ...........................................................

240,311

—

Other assets ......................................................................................

64,757

48,976

Total assets .......................................................................................

$

12,972,243

$

10,706,664

Liabilities

Deposits ...........................................................................................

$

10,540,555

$

9,001,550

Income taxes payable, net ..................................................................

191,499

162,205

Upromise related liabilities .................................................................

293,004

307,518

Other liabilities .................................................................................

117,227

69,248

Total liabilities ..................................................................................

11,142,285

9,540,521

Commitments and contingencies

Equity

Preferred stock, par value $0.20 per share, 20 million shares authorized

Series A: 3.3 million and 0 shares issued, respectively, at stated value

of $50 per share ..............................................................................

165,000

—

Series B: 4 million and 0 shares issued, respectively, at stated value

of $100 per share ............................................................................

400,000

—

Common stock, par value $0.20 per share, 1.125 billion shares

authorized: 425 million and 0 shares, issued, respectively ......................

84,961

—

Additional paid-in capital ...................................................................

1,090,511

—

Navient's subsidiary investment ..........................................................

—

1,164,495

Accumulated other comprehensive loss (net of tax benefit $(7,186) and

$(1,849), respectively) .......................................................................

(11,393

)

(3,024

)

Retained earnings ..............................................................................

113,066

—

Total SLM Corporation's stockholders' equity before treasury stock........

1,842,145

1,161,471

Less: Common stock held in treasury at cost: 1 million and 0 shares,

respectively ......................................................................................

(12,187

)

—

Total SLM Corporation stockholders' equity ........................................

1,829,958

1,161,471

Noncontrolling interest ......................................................................

—

4,672

Total equity ......................................................................................

1,829,958

1,166,143

Total liabilities and equity ..................................................................

$

12,972,243

$

10,706,664

See accompanying notes to consolidated financial statements.

F-4