Sallie Mae 2014 Annual Report Download - page 41

Download and view the complete annual report

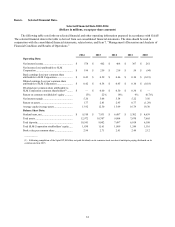

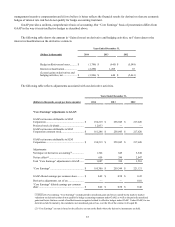

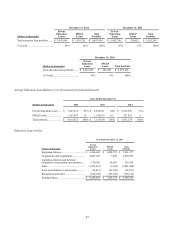

Please find page 41 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2014. As of December 31, 2014, the Bank had a Tier 1 leverage ratio of 11.5 percent, a Tier 1 risk-based capital ratio of 15.0

percent and total risk-based capital ratio of 15.9 percent, exceeding the current regulatory guidelines for well capitalized

institutions by a significant amount.

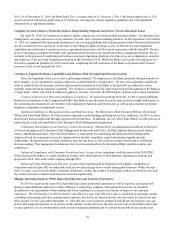

Complete Necessary Steps to Permit the Bank to Independently Originate and Service Private Education Loans

On April 30, 2014, we completed our plan to legally separate into two distinct publicly traded entities - an education loan

management, servicing and asset recovery business, Navient, and a consumer banking business, SLM Corporation. On October

13, 2014, we completed the operational separation of our servicing platforms and related personnel from Navient and launched

our new customer service operation. At the time of this filing, the Bank continues to rely on Navient for loan origination

capabilities provided under a transition services agreement entered into with Navient in connection with the Spin-Off. The key

project remaining to complete the Bank’s full separation from Navient is the separation of these origination functions. We are

currently in the process of completing and testing a new loan originations platform. Our objectives are to implement, complete

and begin use of the new loan originations platform in the first half of 2015. While the Bank is not at risk of losing access to

Navient's originations platform for 2015 and beyond, completing the full separation of the Bank’s operations from Navient

resources is one of our top goals for 2015.

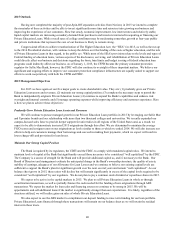

Continue to Expand the Bank’s Capabilities and Enhance Risk Oversight and Internal Controls

Since the beginning of the year we have added approximately 720 employees to the Bank, primarily through transfers of

the Company’ s or its subsidiaries’ existing employees, complemented by external hires. We have also undertaken significant

work to establish that all functions, policies and procedures transferred to the Bank in the Spin-Off are sufficient to meet

currently applicable bank regulatory standards. We continue to prepare for our expected growth and designation of the Bank as

a “large bank,” which will result in enhanced regulatory scrutiny. For 2014, the following key initiatives have been completed.

Creation of Board-level Risk and Compliance Committees. In connection with the Spin-Off, we have created additional

Board-level committees at the Company and Sallie Mae Bank to provide more focused resources and oversight with respect to

the continuing development of our enterprise risk management functions and framework, as well as our consumer protection

regulatory compliance management system.

Significant Additions to Management Team and Risk Functions. We hired a new Chief Executive Officer, Chief Audit

Officer and Chief Risk Officer, all with extensive experience in the banking and financial services industries. In 2014, we have

doubled our Internal Audit staff through experienced external hires. In addition, our new Chief Risk Officer is in the process of

enhancing the talent and capabilities of the Enterprise Risk Management organization.

Continuing Development of our Internal Controls Environment. During 2014, our management and Board of Directors

reviewed and approved the Enterprise Risk Management Framework and Policy, the Risk Appetite Statement and related

metrics, thresholds and limits. Our Chief Risk Officer is responsible for maintaining the Enterprise Risk Management

Framework and its components across the organization to identify, remediate, control and monitor significant risks.

Additionally, the internal risk oversight committee structure has been revised to achieve greater clarity and to consolidate

decision making. Prior management committees have been incorporated into the Enterprise Risk Committee and its sub-

committees.

Enhanced Compliance with Consumer Protection Laws. As part of our compliance with the terms of the 2014 FDIC

Order discussed elsewhere, we made significant changes and enhancements to our compliance management systems and

program in 2014. This work will be ongoing through 2015.

Enhanced Vendor Management Function. As part of the transition and development of the Bank’s capabilities in

connection with the Spin-Off, we undertook a full review and redesign of our vendor management function. While Navient

will, over time, cease to be the Bank’s dominant, third-party vendor, the number of third-party vendors on whom we rely and

the volume of work we obtain from them has increased significantly.

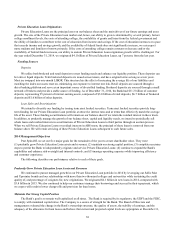

Manage Operating Expenses While Improving Efficiency and Customer Experience

In 2014 we incurred the costs of the Spin-Off and related operational separation as well as expenses associated with

having to add additional employees to fully staff up as a stand-alone company. Throughout this process we remained

disciplined in our expenditures while making sure we are making the necessary investments to improve our customer

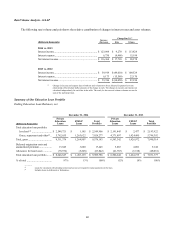

experience. We will measure our effectiveness by our efficiency ratio. Our efficiency ratio is calculated as operating expense,

excluding restructuring and other reorganization expenses, divided by net interest income after provision for loan losses and

other income. For the year ended December 31, 2014 this ratio was 43 percent compared with 40 percent from the year-ago

period. Our long-term objective is to achieve steady declines in this ratio over the next several years as the balance sheet and

revenue grows to a level commensurate with our loan origination platform and we control the growth of our expense base.

39