Sallie Mae 2014 Annual Report Download - page 38

Download and view the complete annual report

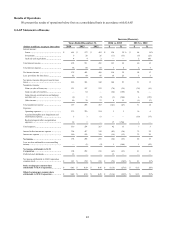

Please find page 38 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Charge-Offs and Delinquencies

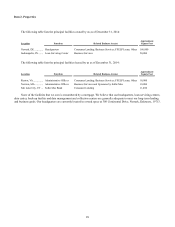

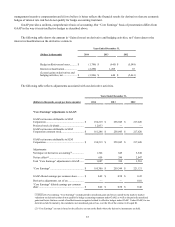

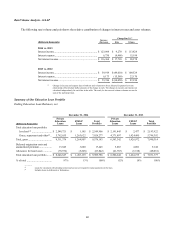

Delinquencies are a very important indicator of potential future credit performance. When a Private Education Loan

reaches 120 days delinquent it is charged against the allowance for loan losses. Charge-off data provides relevant information

with respect to the performance of our loan portfolios. Management focuses on delinquencies as well as the progression of

loans from early to late stage delinquency. Prior to the Spin-Off, the Bank would sell delinquent loans to an entity that is now a

subsidiary of Navient when the loans became 90 days delinquent. As a result, there were no charge-offs recorded in our

financial statements prior to April 1, 2014. In addition, because loans were sold earlier in their delinquency status, the historical

delinquency statistics are not necessarily indicative of expected future performance.

Private Education Loan delinquencies as a percentage of Private Education Loans in repayment increased from

1.0 percent at December 31, 2013 to 2.0 percent at December 31, 2014. Private Education Loans in forbearance as a percentage

of Private Education Loans in repayment and forbearance increased from 0.4 percent at December 31, 2013 to 2.6 percent at

December 31, 2014.

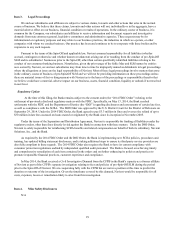

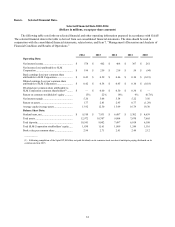

Operating Expenses

The operating expenses reported are those that are directly attributable to the Company, the costs of Transition Services

Agreements with Navient, and restructuring costs associated with the build-out of our servicing platform and the remaining

costs of the Spin-Off. We separately disclose “restructuring and other reorganization expenses”, which represent costs we

believe are directly attributable to completing the Spin-Off. Restructuring and other reorganization expenses were $38 million

for the year ended December 31, 2014 compared with $1 million in 2013. Our efficiency ratio is calculated as operating

expense, excluding restructuring and other reorganization expenses, divided by net interest income after provision for loan

losses and other income. For the year ended December 31, 2014 this ratio was 43 percent compared to 40 percent from the

year-ago period. Our long-term objective is to achieve steady declines in this ratio over the next several years as the balance

sheet and revenue grows to a level commensurate our loan origination platform and we control the growth of our expense base.

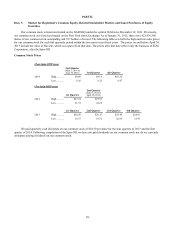

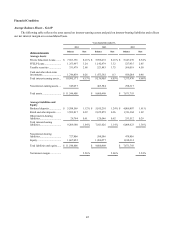

Core Earnings

We prepare financial statements in accordance with GAAP. However, we also produce and report our after-tax earnings

on a separate basis which we refer to as “Core Earnings.” While pre-Spin-Off SLM also reported a metric by that name, what

we now report and what we describe below is significantly different and should not be compared to any Core Earnings reported

by pre-Spin-Off SLM.

“Core Earnings” recognizes the difference in accounting treatment based upon whether the derivative qualifies for hedge

accounting treatment and eliminates the earnings impact associated with hedge ineffectiveness and derivatives we use as an

economic hedge but do not qualify for hedge accounting treatment. We enter into derivatives instruments to economically

hedge interest rate and cash flow risk associated with our portfolio. We believe that our derivatives are effective economic

hedges, and as such, are a critical element of our interest rate risk management strategy. Those derivative instruments that

qualify for hedge accounting treatment have their related cash flows recorded in interest income or interest expense along with

the hedged item. Hedge ineffectiveness related to these derivatives is recorded in "Gains (losses) on derivatives and hedging

activities, net." Some of our derivatives do not qualify for hedge accounting treatment and the stand-alone derivative must be

marked-to-fair value in the income statement with no consideration for the corresponding change in fair value of the hedged

item. These gains and losses, recorded in “Gains (losses) on derivative and hedging activities, net”, are primarily caused by

interest rate volatility and changing credit spreads during the period as well as the volume and term of derivatives not receiving

hedge accounting treatment. Cash flows on derivative instruments that do not qualify for hedge accounting are not recorded in

interest income and interest expense; they are recorded in non-interest income: “gains (losses) on derivative and hedging

activities, net.”

The adjustments required to reconcile from our “Core Earnings” results to our GAAP results of operations, net of tax,

relate to differing treatments for our use of derivative instruments to hedge our economic risks that do not qualify for hedge

accounting treatment or do qualify for hedge accounting treatment but result in ineffectiveness, net of tax. The amount recorded

in “Gains (losses) on derivative and hedging activities, net” includes the accrual of the current payment on the interest rate

swaps that do not qualify for hedge accounting treatment as well as the change in fair values related to future expected cash

flows for derivatives and accounting hedges. For purposes of “Core Earnings” we are including in GAAP earnings the current

period accrual amounts (interest reclassification) on the swaps and exclude the remaining ineffectiveness. “Core Earnings” is

meant to represent what earnings would have been had these derivatives qualified for hedge accounting and there was no

ineffectiveness.

“Core Earnings” are not a substitute for reported results under GAAP. We provide “Core Earnings” basis of presentation

because (i) earnings per share computed on a “Core Earnings” basis is one of several measures we utilize in establishing

36