Sallie Mae 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146

|

|

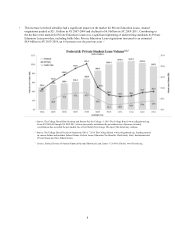

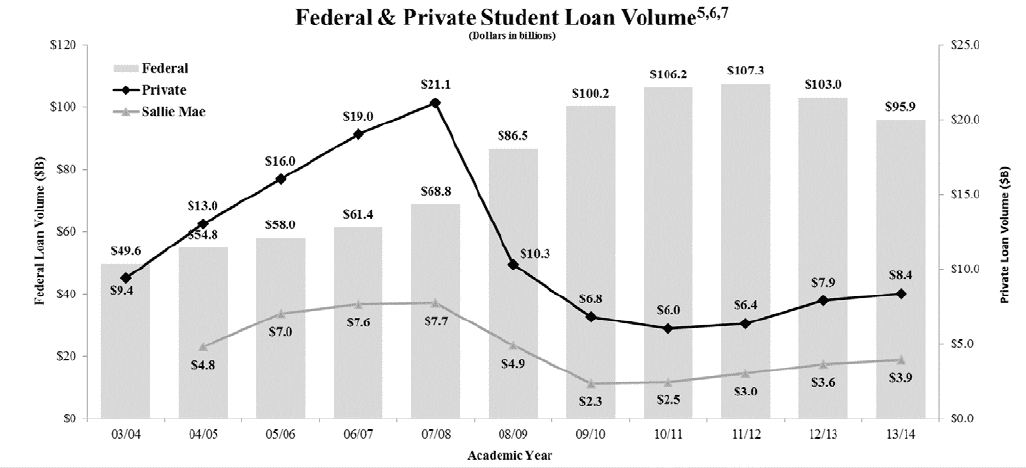

• This increase in federal subsidies had a significant impact on the market for Private Education Loans. Annual

originations peaked at $21.1 billion in AY 2007-2008 and declined to $6.0 billion in AY 2010-2011. Contributing to

the decline in the market for Private Education Loans was a significant tightening of underwriting standards by Private

Education Loan providers, including Sallie Mae. Private Education Loan originations increased to an estimated

$8.4 billion in AY 2013-2014, up 6.0 percent over the previous year. 6,7

5 Source: The College Board-How Students and Parents Pay for College. © 2013 The College Board. www.collegeboard.org.

Fr o m AY 2 0 08-09 through AY 2012-2013 at four-year public institutions the per student rate of increase in family

contributions has exceeded the per student rate of total family borrowings. We expect this trend may continue.

6 Source: The College Board-Trends in Student Aid 2014. © 2014 The College Board. www.collegeboard.org. Funding sources

in current dollars and includes Federal Grants, Federal Loans, Education Tax Benefits, Work Study, State, Institutional and

Private Grants and Non-Federal Loans.

7 Source: FinAid, History of Student Financial Aid and Historical Loan Limits. © 2014 by FinAid. www.FinAid.org.

8