Sallie Mae 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

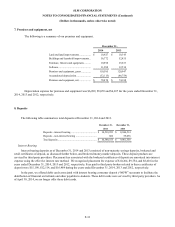

5.

Loans Held for Investment (Continued)

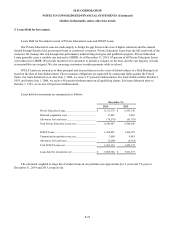

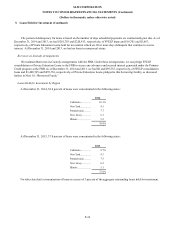

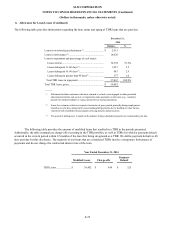

The period of delinquency for loans is based on the number of days scheduled payments are contractually past due. As of

December 31, 2014 and 2013, we had $201,703 and $220,413, respectively, of FFELP loans and $10,701 and $2,667,

respectively, of Private Education Loans held for investment which are 90 or more days delinquent that continue to accrue

interest. At December 31, 2014 and 2013, we had no loans in nonaccrual status.

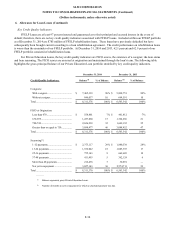

Borrower-in-Custody Arrangements

We maintain Borrower-in-Custody arrangements with the FRB. Under these arrangements, we can pledge FFELP

consolidation or Private Education Loans to the FRB to secure any advances and accrued interest generated under the Primary

Credit program at the FRB. As of December 31, 2014 and 2013, we had $0 and $95,555, respectively, of FFELP consolidation

loans and $1,408,745 and $870,736, respectively, of Private Education Loans pledged to this borrowing facility, as discussed

further in Note 10, “Borrowed Funds.”

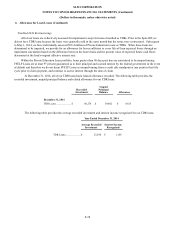

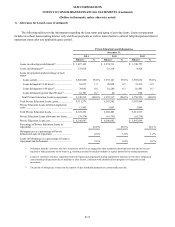

Loans Held for Investment by Region

At December 31, 2014, 38.8 percent of loans were concentrated in the following states:

2014

California ..............

10.1

%

Ne w Yo rk ..............

9.5

Pennsylvania .........

7.7

New Jersey ............

6.3

Illinois ..................

5.2

38.8

%

At December 31, 2013, 37.8 percent of loans were concentrated in the following states:

2013

California ..............

9.7

%

Ne w Yo rk ..............

9.3

Pennsylvania .........

7.5

New Jersey ............

6.2

Illinois ..................

5.1

37.8

%

No other state had a concentration of loans in excess of 5 percent of the aggregate outstanding loans held for investment.

F-24