Sallie Mae 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

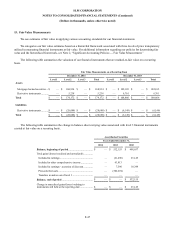

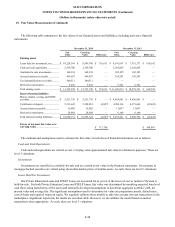

15.

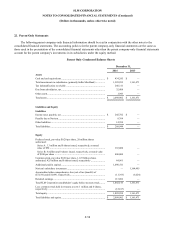

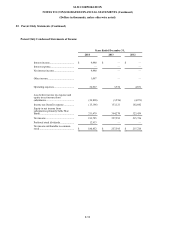

Fair Value Measurements (Continued)

Accrued Interest Receivable

Accrued interest receivable is carried at cost. The carrying value approximates fair value due to its short-term nature.

This is a level 1 valuation.

Tax Indemnification Receivable

Tax indemnification receivable is carried at cost. The carrying value approximates fair value. This is a level 1 valuation.

Money Market, Savings Accounts and NOW Accounts

The fair value of money market, savings, and NOW accounts equal the amounts payable on demand at the balance sheet

date and are reported at their carrying value. These are level 1 valuations.

Certificates of Deposit

The fair value of certificates of deposit are estimated using discounted cash flows based on rates currently offered for

deposits of similar remaining maturities. These are level 2 valuations.

Accrued Interest Payable

Accrued interest payable is carried at cost. The carrying value approximates fair value due to its short-term nature. This is a

level 1 valuation.

Derivatives

All derivatives are accounted for at fair value in the financial statements. The fair value of derivative financial

instruments was determined by a standard derivative pricing and option model using the stated terms of the contracts and

observable market inputs. It is our policy to compare the derivative fair values to those received from our counterparties in

order to evaluate the model’s outputs.

When determining the fair value of derivatives, we take into account counterparty credit risk for positions where we are

exposed to the counterparty on a net basis by assessing exposure net of collateral held. When the counterparty has exposure to

us under derivative contracts with the Company, we fully collateralize the exposure (subject to certain thresholds).

Interest rate swaps are valued using a standard derivative cash flow model with a LIBOR swap yield curve which is an

observable input from an active market. These derivatives are level 2 fair value estimates in the hierarchy.

The carrying value of borrowings designated as the hedged item in a fair value hedge is adjusted for changes in fair value

due to changes in the benchmark interest rate (one-month LIBOR). These valuations are determined through standard pricing

models using the stated terms of the borrowings and observable yield curves.

F-49