Sallie Mae 2014 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

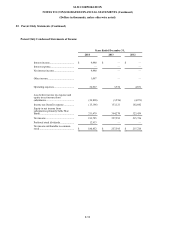

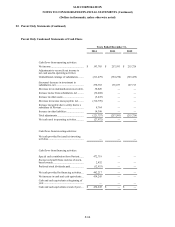

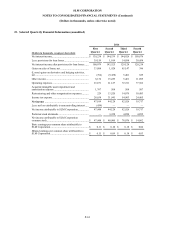

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

23.

Selected Quarterly Financial Information (unaudited) (Continued)

2013

First

Second

Third

Fourth

(Dollars in thousands, except per share data)

Quarter

Quarter

Quarter

Quarter

Net interest income...................................................

$

115,702

$

107,417

$

116,783

$

122,213

Less: provisions for loan losses ..................................

20,692

(1,015

)

20,404

29,258

Net interest income after provisions for loan losses ......

95,010

108,432

96,379

92,955

Gains on sales of loans, net .......................................

75,222

73,441

43,434

4,496

Gains (losses) on derivative and hedging activities,

net ..........................................................................

610

(52

)

297

(215

)

Other income ...........................................................

7,799

8,665

9,416

75,155

Operating expenses ..................................................

60,771

66,771

68,717

74,215

Acquired intangible asset impairment and

amortization expense ................................................

537

536

1,480

764

Restructuring and other reorganization expenses..........

23

84

—

619

Income tax expense ..................................................

44,765

46,973

30,272

36,923

Net income .............................................................

72,545

76,122

49,057

59,870

Less: net loss attributable to noncontrolling interest .....

(340

)

(347

)

(333

)

(332

)

Net income attributable to SLM Corporation ...............

72,885

76,469

49,390

60,202

Preferred stock dividends ..........................................

—

—

—

—

Net income attributable to SLM Corporation

common stock..........................................................

$

72,885

$

76,469

$

49,390

$

60,202

Basic earnings per common share attributable to

SLM Corporation .....................................................

$

0.16

$

0.17

$

0.11

$

0.14

Diluted earnings per common share attributable to

SLM Corporation .....................................................

$

0.16

$

0.17

$

0.11

$

0.14

F-62