Sallie Mae 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

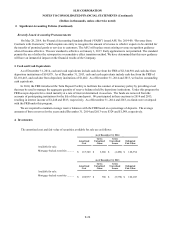

5. Loans Held for Investment

Loans Held for Investment consist of Private Education Loans and FFELP Loans.

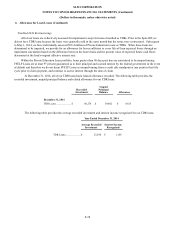

Our Private Education Loans are made largely to bridge the gap between the cost of higher education and the amount

funded through financial aid, government loans or customers’ resources. Private Education Loans bear the full credit risk of the

customer. We manage this risk through risk-performance underwriting strategies and qualified cosigners. Private Education

Loans generally carry a variable rate indexed to LIBOR. As of December 31, 2014, 83 percent of all Private Education Loans

were indexed to LIBOR. We provide incentives for customers to include a cosigner on the loan, and the vast majority of loans

in our portfolio are cosigned. We also encourage customers to make payments while in school.

FFELP Loans are insured as to their principal and accrued interest in the event of default subject to a Risk Sharing level

based on the date of loan disbursement. These insurance obligations are supported by contractual rights against the United

States. For loans disbursed on or after July 1, 2006, we receive 97 percent reimbursement. For loans disbursed after October 1,

1993, and before July 1, 2006, we receive 98 percent reimbursement on all qualifying claims. For loans disbursed prior to

October 1, 1993, we receive 100 percent reimbursement.

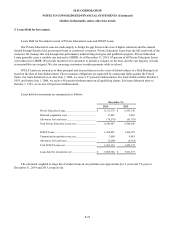

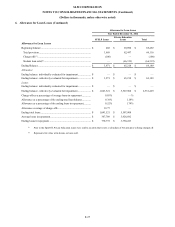

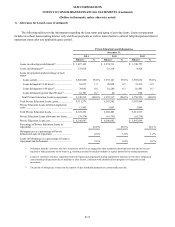

Loans held for investment are summarized as follows:

December 31,

2014

2013

Private Education Loans ..........................................

$

8,311,376

$

6,563,342

Deferred origination costs ........................................

13,845

5,063

Allowance for loan losses ........................................

(78,574

)

(61,763

)

Total Private Education Loans, net............................

8,246,647

6,506,642

FFELP Loans .........................................................

1,264,807

1,426,972

Unamortized acquisition costs, net ............................

3,600

4,081

Allowance for loan losses ........................................

(5,268

)

(6,318

)

Total FFELP Loans, net ...........................................

1,263,139

1,424,735

Loans held for investment, net .................................

$

9,509,786

$

7,931,377

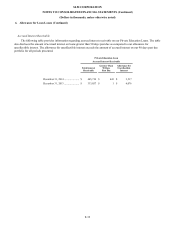

The estimated weighted average life of student loans in our portfolio was approximately 6.2 years and 7.0 years at

December 31, 2014 and 2013, respectively.

F-22