Sallie Mae 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

2.

Significant Accounting Policies (Continued)

Depending on the availability of observable inputs and prices, different valuation models could produce materially different fair

value estimates. The values presented may not represent future fair values and may not be realizable.

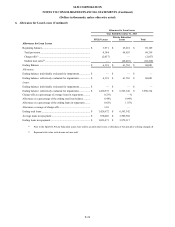

We categorize our fair value estimates based on a hierarchical framework associated with three levels of price

transparency utilized in measuring financial instruments at fair value. Classification is based on the lowest level of input that is

significant to the fair value of the instrument. The three levels are as follows:

• Level 1 — Quoted prices (unadjusted) in active markets for identical assets or liabilities that we have the ability to

access at the measurement date. The types of financial instruments included in level 1 are highly liquid instruments with

quoted prices.

• Level 2 — Inputs from active markets, other than quoted prices for identical instruments, are used to determine fair

value. Significant inputs are directly observable from active markets for substantially the full term of the asset or

liability being valued.

• Level 3 — Pricing inputs significant to the valuation are unobservable. Inputs are developed based on the best

information available. However, significant judgment is required by us in developing the inputs.

Loan Interest Income

For loans classified as held for investment, we recognize interest income as earned, adjusted for the amortization of

deferred direct origination costs. This adjustment is recognized based upon the expected yield of the loan over its life after

giving effect to prepayments and extensions. The estimate of the prepayment speed includes the effect of voluntary

prepayments, student loan defaults, and consolidation (if the loan is consolidated to a third party), all of which shorten the life-

of-loan. Prepayment speed estimates also consider the utilization of deferment, forbearance, and extended repayment plans,

which lengthen the life-of-loan. We regularly evaluate the assumptions used to estimate the prepayment speeds. In instances

where there are changes to the assumptions, amortization is adjusted on a cumulative basis to reflect the change since the

origination of the loan. We also pay to the U.S. Department of Education (“ED”) an annual 105 basis point Consolidation Loan

Rebate Fee on FFELP Consolidation Loans which is netted against loan interest income. Additionally, interest earned on

education loans reflects potential non-payment adjustments in accordance with our uncollectible interest recognition policy as

discussed further in “Allowance for Loan Losses” of this Note 2. We do not amortize any adjustments to the basis of education

loans when they are classified as held-for-sale.

We recognize certain fee income (primarily late fees) on education loans when earned according to the contractual

provisions of the promissory notes, as well as our expectation of collectability. Fee income is recorded when earned in “other

non-interest income” in the accompanying consolidated statements of income.

Interest Expense

Interest expense is based upon contractual interest rates adjusted for the amortization of issuance costs. We incur interest

expense on interest bearing deposits comprised of non-maturity savings deposits, brokered and retail certificates of deposit and

brokered money market deposits. Interest expense is recognized when amounts are contractually due to deposit holders. Refer

to Note 8, “Deposits,” for further details of interest bearing deposits.

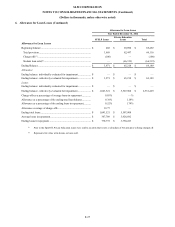

Gains on Sale of Loans, Net

We participate and sell loans to third parties and affiliates (including entities that were related parties prior to the Spin-

Off). These sales may be through whole loan sales or securitization transactions that qualify for sales treatment. These loans

were initially recorded as held for investment, and were transferred to held-for-sale immediately prior to sale or securitization.

Beginning in April 2012, loans were sold at fair value. Details of these transactions are further discussed in Note 16,

“Arrangements with Navient Corporation.”

Prior to the Spin-Off the Bank sold loans to an entity that is now a subsidiary of Navient when loans became 90 days

delinquent and to facilitate securitization transactions. Prior to the Spin-Off, the Bank sold $805 million, $2.4 billion and $2.6

billion of loans resulting in a net gain on sale of loans of $36 million, $197 million and $235 million, for the years ended

F-17