Sallie Mae 2014 Annual Report Download - page 19

Download and view the complete annual report

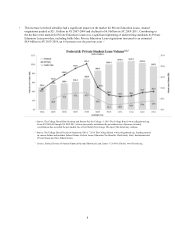

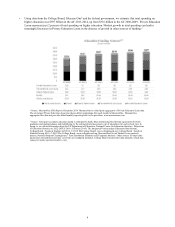

Please find page 19 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Section 529 plans, which include both prepaid tuition plans and college savings plans that allow a family to save funds

on a tax-advantaged basis;

• Education IRAs, now known as Coverdell Education Savings Accounts, under which a holder can make annual

contributions for education savings;

• Government education loan programs such as the DSLP; and

• Direct loans from colleges and universities.

If demand for Private Education Loans weakens, we would experience reduced demand for our products and services,

which could have a material adverse effect on our business, financial condition and results of operations.

We are dependent on key personnel and the loss of one or more of those key personnel could harm our business.

Our future success depends significantly on the continued services and performance of our management team. We believe

our management team’ s depth and breadth of experience in our industry is integral to executing our business plan. We also will

need to continue to attract, motivate and retain other key personnel. The loss of the services of members of our management

team or other key personnel to our competitors or the inability to attract additional qualified personnel as needed could have a

material adverse effect on our business, financial position, results of operations and cash flows.

Regulatory

Failure to comply with consumer protection laws could subject us to civil and criminal penalties or litigation, including

class actions, and have a material adverse effect on our business.

We are subject to a broad range of federal and state consumer protection laws applicable to our Private Education Loan

lending and retail banking activities, including laws governing fair lending, unfair, deceptive and abusive acts and practices,

service member protections, interest rates and loan fees, disclosures of loan terms, marketing, servicing and collections.

Violations or changes in federal or state consumer protection laws or related regulations, or in the prevailing

interpretations thereof, may expose us to litigation, result in greater compliance costs, constrain the marketing of Private

Education Loans, adversely affect the collection of balances due on the loan assets held by us or by securitization trusts or

otherwise adversely affect our business. We could incur substantial additional expense complying with these requirements and

may be required to create new processes and information systems. Moreover, changes in federal or state consumer protection

laws and related regulations, or in the prevailing interpretations thereof, could invalidate or call into question the legality of

certain of our services and business practices.

For example, the Bank is currently subject to a Consent Order, Order to Pay Restitution and Order to Pay Civil Money

Penalty issued by the FDIC and a Consent Order entered into with the Department of Justice. Specifically, on May 13, 2014,

the Bank reached settlements with the FDIC and the Department of Justice regarding disclosures and assessments of certain late

fees, as well as compliance with the SCRA.

Violations of the laws or regulations governing our operations could result in the imposition of civil or criminal penalties

or our exclusion from participating in education loan programs. These penalties or exclusions, were they to occur, would impair

our business reputation and ability to operate our business. In some cases, such violations may render the loan assets

unenforceable.

We operate in a highly regulated environment and the laws and regulations that govern our operations, or changes in them,

or our failure to comply with them, may adversely affect us.

In addition to consumer protection laws, we are also subject to extensive regulation and supervision that govern almost all

aspects of our operations. Intended to protect clients, depositors, the DIF, and the overall financial system, these laws and

regulations, among other matters, prescribe minimum capital requirements, impose limitations on the business activities in

which we can engage, limit the dividend or distributions the Bank can pay to us, restrict the ability of institutions to guarantee

our debt, limit proprietary trading and investments in certain private funds, impose certain specific accounting requirements on

us that may be more restrictive and may result in greater or earlier charges to earnings or reductions in our capital than

generally accepted accounting principles, among other things. Compliance with laws and regulations can be difficult and costly,

and changes to laws and regulations, as well as increased intensity in supervision, often impose additional compliance costs.

We, like the rest of the banking sector, are facing increased regulation and supervision of our industry by the federal bank

regulatory agencies and expect that there will be additional and changing requirements and conditions imposed on us. Effective

January 1, 2015, the CFPB became the Bank’s primary consumer compliance supervisor, with consumer compliance

examination authority and primary consumer compliance enforcement authority. CFPB jurisdiction could result in additional

17