Sallie Mae 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

12.

Stockholders' Equity (Continued)

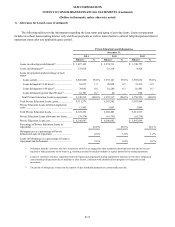

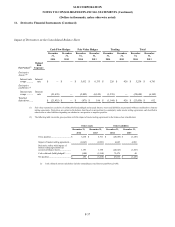

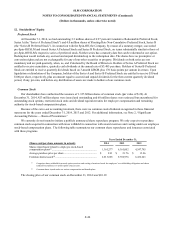

Investment With Entities That Are Now Subsidiaries of Navient

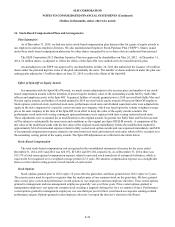

Prior to the Spin-Off, there were transactions between us and affiliates of pre-Spin-Off SLM that are now subsidiaries of

Navient. As part of the carve-out, these expenses were included in our results even though the actual payments for the expenses

were paid by the aforementioned affiliates. As such, amounts equal to these payments have been treated as equity contributions

in the table below. Certain payments made by us to these affiliates prior to the Spin-Off were treated as dividends.

Net transfers (to)/from the entity that is now a subsidiary of Navient are included within Navient's subsidiary investment

on the consolidated statements of changes in equity. The components of the net transfers (to)/from the entity that is now a

subsidiary of Navient are summarized below:

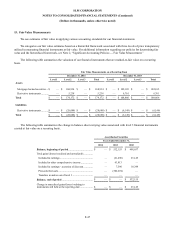

Years Ended December 31,

2014

2013

2012

Capital contributions:

Loan origination activities ..........................

$

32,452

$

124,722

$

119,094

Loan sales .................................................

45

35

13,502

Corporate overhead activities ......................

21,216

62,031

69,830

Special cash contribution ............................

472,718

—

—

Other ........................................................

19,650

2,004

5,429

Total capital contributions .............................

546,081

188,792

207,855

Dividend .....................................................

—

(120,000

)

(420,000

)

Corporate push-down ...................................

4,977

3,093

1,241

Net change in income tax accounts ................

15,659

(134,219

)

(78,842

)

Net change in receivable/payable ...................

(87,277

)

(101,044

)

(94,264

)

Other ..........................................................

(31

)

—

—

Total net transfers (to)/from the entity that is

now a subsidiary of Navient ..........................

$

479,409

$

(163,378

)

$

(384,010

)

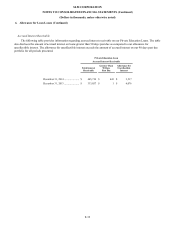

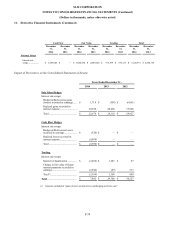

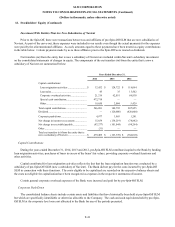

Capital Contributions

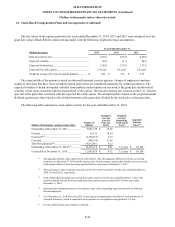

During the years ended December 31, 2014, 2013 and 2012, pre-Spin-Off SLM contributed capital to the Bank by funding

loan origination activities, purchases of loans in excess of the loans’ fair values, providing corporate overhead functions and

other activities.

Capital contributed for loan origination activities reflects the fact that the loan origination function was conducted by a

subsidiary of pre-Spin-Off SLM (now a subsidiary of Navient). The Bank did not pay for the costs incurred by pre-Spin-Off

SLM in connection with these functions. The costs eligible to be capitalized are recorded on the respective balance sheets and

the costs not eligible for capitalization have been recognized as expenses in the respective statements of income.

Certain general corporate overhead expenses of the Bank were incurred and paid for by pre-Spin-Off SLM.

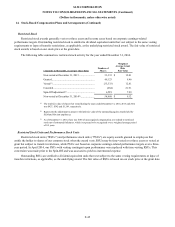

Corporate Push-Down

The consolidated balance sheets include certain assets and liabilities that have historically been held at pre-Spin-Off SLM

but which are specifically identifiable or otherwise allocable to the Company. The cash and cash equivalents held by pre-Spin-

Off SLM at the corporate level were not allocated to the Bank for any of the periods presented.

F-41