Sallie Mae 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

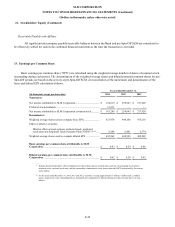

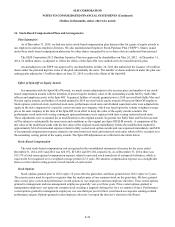

14.

Stock-Based Compensation Plans and Arrangements (Continued)

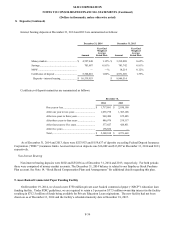

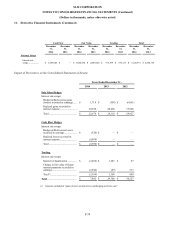

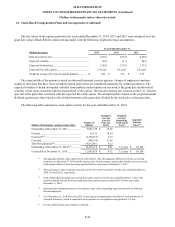

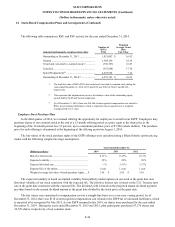

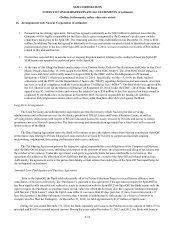

The fair values of the options granted in the years ended December 31, 2014, 2013 and 2012 were estimated as of the

grant date using a Black-Scholes option pricing model with the following weighted average assumptions:

Years Ended December 31,

(Dollars per share)

2014

2013

2012

Risk-free interest rate ...................................................

0.76

%

0.65

%

0.60

%

Expected volatility .......................................................

26

%

31

%

44

%

Expected dividend rate .................................................

2.48

%

3.35

%

3.13

%

Expected life of the option ............................................

2.9 years

2.8 years

2.8 years

Weighted average fair value of options granted ...............

$

3.48

$

3.11

$

4.12

The expected life of the options is based on observed historical exercise patterns. Groups of employees (and non-

employee directors) that have received similar option grant terms are considered separately for valuation purposes. The

expected volatility is based on implied volatility from publicly traded options on our stock at the grant date and historical

volatility of our stock consistent with the expected life of the option. The risk-free interest rate is based on the U.S. Treasury

spot rate at the grant date consistent with the expected life of the option. The dividend yield is based on the projected annual

dividend payment per share based on the dividend amount at the grant date, divided by the stock price at the grant date.

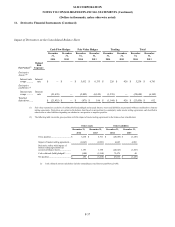

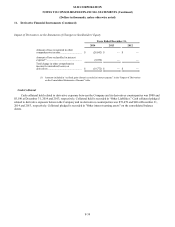

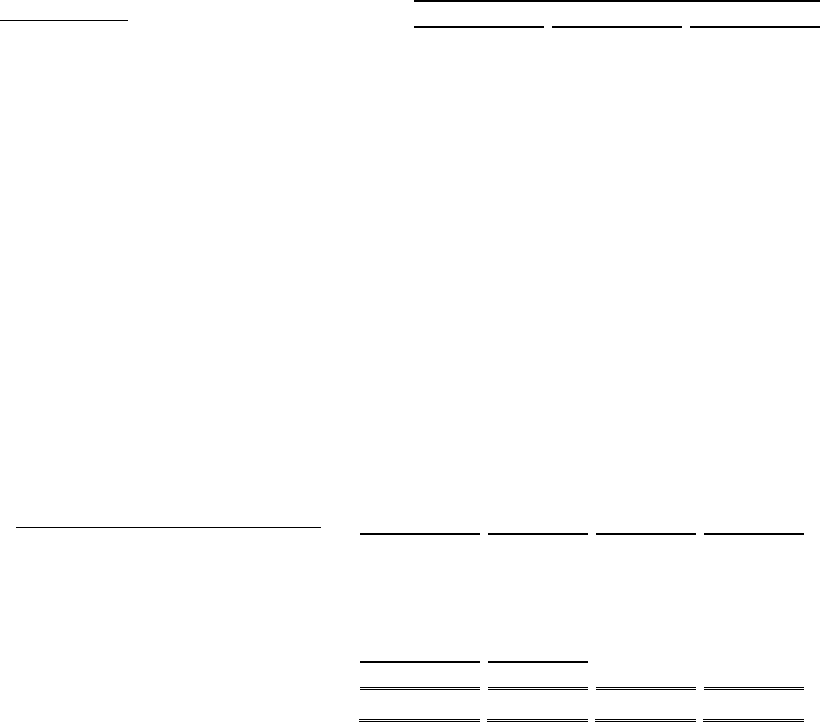

The following table summarizes stock option activity for the year ended December 31, 2014.

(Dollars in thousands, except per share data)

Number of

Options

Weighted

Average

Exercise

Price per

Share

Weighted

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

(1)

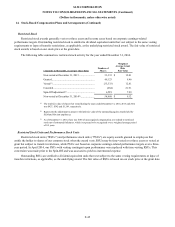

Outstanding at December 31, 2013 ..................

3,851,120

$

14.60

Granted ........................................................

16,132

24.24

Exercised(2)(3) ................................................

(2,196,575

)

6.19

Canceled ......................................................

(148,159

)

21.86

Spin-Off adjustment(4) ....................................

14,632,601

8.22

Outstanding at December 31, 2014(5)(6) ............

16,155,119

$

9.91

3.2 years

$

62,144

Exercisable at December 31, 2014 ...................

12,985,828

$

8.32

3.2 years

$

50,154

(1) The aggregate intrinsic value represents the total intrinsic value (the aggregate difference between our closing

stock price on December 31, 2014 and the exercise price of in-the-money options) that would have been received

by the option holders if all in-the-money options had been exercised on December 31, 2014.

(2) The total intrinsic value of options exercised was $11,430, $8,467 and $5,410 for the years ended December 31,

2014, 2013 and 2012, respectively.

(3) Cash of Fifty-three thousand was received from option exercises for the year ended December 31, 2014. The

actual tax benefit realized for the tax deductions from option exercises totaled $4,853 for the year ended

December 31, 2014.

(4) Represents the adjustment to preserve the intrinsic value of the outstanding equity awards held by SLM and

Navient employees.

(5) As of December 31, 2014, there was $362 of unrecognized compensation cost related to stock options net of

estimated forfeitures, which is expected to be recognized over a weighted average period of 1.0 year.

(6) For net-settled options, gross number is reflected.

F-44