Sallie Mae 2014 Annual Report Download - page 97

Download and view the complete annual report

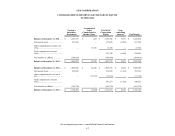

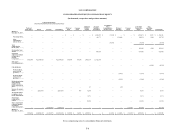

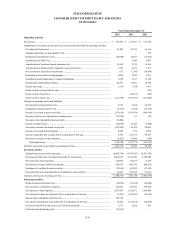

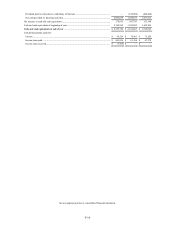

Please find page 97 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

2.

Significant Accounting Policies (Continued)

Investments

Investments include mortgage-backed securities in 2014, and asset-backed securities and mortgage-backed securities in

2013 and 2012. We record our investment purchases and sales on a trade date basis. The amortized cost of debt securities is

adjusted for amortization of premiums and accretion of discounts, which are amortized using the effective interest rate method.

We classify all of our investments with readily determinable fair values as trading, available-for-sale or held-to-maturity.

Investments that are not categorized as trading or held-to-maturity are classified as available-for-sale and reported at fair

value. Unrealized gains or losses on available-for-sale investments are recorded in equity and are reported as a component of

other comprehensive income/(loss), net of applicable income taxes, unless a decline in the investment’s value is considered to

be other-than-temporary, in which case the loss is recorded directly to earnings.

Management reviews all investments at least quarterly to determine whether any impairment is other-than-temporary.

Impairment is evaluated by considering several factors including the length of time and extent to which the fair value has been

less than cost, the financial condition and near-term prospects of the issuer, and the intent and ability to retain the investment to

allow for an anticipated recovery in fair value. If, based on the analysis, it is determined that the impairment is other-than-

temporary, the investment is written down to fair value and a loss is recognized through earnings.

Loans Held for Investment

Loans, consisting of Private Education Loans and FFELP loans, that we have the ability and intent to hold for the

foreseeable future are classified as held for investment, and are carried at amortized cost. Amortized cost includes the

unamortized premiums, discounts, and capitalized origination costs and fees, all of which are amortized to interest income as

discussed under “Loan Interest Income.” Loans which are held for investment are reported net of an allowance for loan losses.

Prior to the Spin-Off, we participated in FFELP rehabilitation loan auctions whereby we bid on portfolios of rehabilitated

FFELP loans offered for sale by guarantors. For a loan to be eligible for rehabilitation, the guaranty agency must have received

reasonable and affordable payments for 9 out of 10 months, at which time the borrower may request that the loan be

rehabilitated. Because monthly payments are usually greater after rehabilitation, not all borrowers request rehabilitation. Upon

rehabilitation, a borrower is again eligible for all of the benefits under the Higher Education Act that he or she was not eligible

as a borrower on a defaulted loan, such as new federal aid, and the default on the borrower’s credit record is expunged. No

student loan may be rehabilitated more than once. We purchased $7,464 and $474,293 of these loans in 2014 and 2013,

respectively, at 101.67 percent to 95 percent of par value. These loans are subject to our Allowance for Loan Loss reserve

methodology. We no longer intend to purchase any FFELP loans.

Allowance for Loan Losses

We consider a loan to be impaired when, based on current information, a loss has been incurred and it is probable that we

will not receive all contractual amounts due. When making our assessment as to whether a loan is impaired, we also take into

account more than insignificant delays in payment. We generally evaluate impaired loans on an aggregate basis by grouping

similar loans. We maintain an allowance for loan losses at an amount sufficient to absorb probable losses incurred in our

portfolios at the reporting date based on a projection of estimated probable credit losses incurred in the portfolio.

We analyze our portfolios to determine the effects that the various stages of delinquency and forbearance have on

borrower default behavior and ultimate charge off. We estimate the allowance for loan losses for our loan portfolios using

migration analysis of delinquent and current accounts. A migration analyses is a technique used to estimate the likelihood that a

loan receivable may progress through the various delinquency stages and ultimately charge off. We also take into account the

current and future economic environment and certain other qualitative factors when calculating the allowance for loan losses.

The evaluation of the allowance for loan losses is inherently subjective, as it requires material estimates that may be

susceptible to significant changes. Our default estimates are based on a loss confirmation period of one year for Private

F-13