Sallie Mae 2014 Annual Report Download - page 52

Download and view the complete annual report

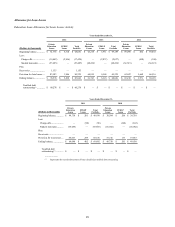

Please find page 52 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Private Education Loan Allowance for Loan Losses

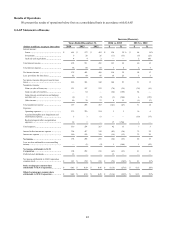

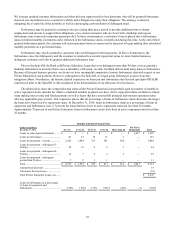

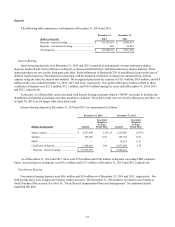

In establishing the allowance for Private Education Loan losses as of December 31, 2014, we considered several factors

with respect to our Private Education Loan portfolio, in particular, credit quality and delinquency, forbearance and charge-off

trends in connection with the portfolio.

Private Education Loan provision for loan losses increased $18.6 million compared with the year-ago period. The

increase was primarily the result of an increase in charge-offs, an increase in our troubled debt restructurings (for which we

hold a life-of-loan allowance), an increase in the percentage of loans in full principal and interest repayment and fewer loan

sales. Prior period amounts also included the effect of our past policy of a two-year loss emergence period and the change in

our charge-off policy. In addition, in the prior periods we did not have troubled debt restructurings, loans in forbearance or a

significant amount of loans that were more than 90 days past due because we typically sold loans to an affiliate prior to any

restructuring and when they became 90 days delinquent. As a result of this past practice, there were no recoveries of defaulted

loans prior to 2014.

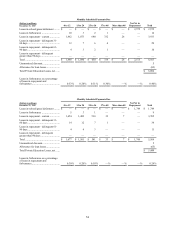

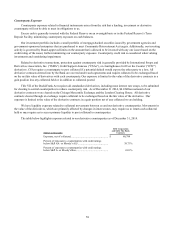

When loans are sold at a gain we reverse the allowance for loan losses related to these loans by recording a negative

provision. When we sell loans at a loss due to credit deterioration, we write down the loan to fair value with the additional

write-down recorded as provision expense. In 2014 we had a decrease in loans sold for gains and loans sold for losses

compared with the year-ago period. The net effect of these sales in 2014 was to reduce the allowance for loan losses by $53.5

million compared with a reduction in 2013 of $68.4 million.

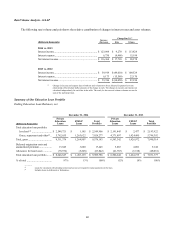

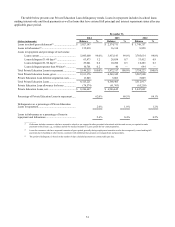

Total loans delinquent (as a percentage of loans in repayment) have increased to 2.0 percent from 1.0 percent in the year-

ago period. Loans in forbearance (as a percentage of loans in repayment and forbearance) have increased to 2.6 percent from

0.4 percent in the year-ago period. The increase in the loans in forbearance was because in the prior year the Bank typically sold

loans to an entity that is now a subsidiary of Navient in the same month a forbearance was offered to a borrower. Post-Spin-Off,

the Bank now retains loans that have gone into forbearance.

For a more detailed discussion of our policy for determining the collectability of Private Education Loans and

maintaining our allowance for Private Education Loan losses, see Item 7. “Management’ s Discussion and Analysis of Financial

Condition and Results of Operations - Critical Accounting Policies and Estimates - Allowance for Loan Losses.”

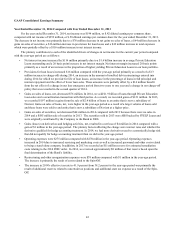

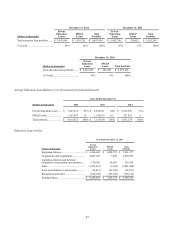

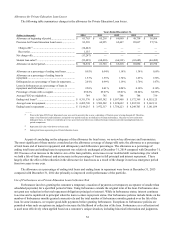

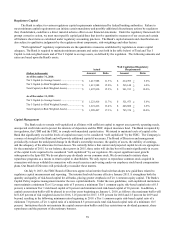

Our default aversion strategies are focused on the final stages of delinquency. Pre-Spin-Off these final stages were from

150 days to 212 days delinquent. As a result of changing our corporate charge-off policy and greatly reducing the number of

potentially delinquent loans we sell to Navient, the final stages of delinquency and our default aversion strategies now focus

more on loans 30 to 120 days delinquent. This change has the effect of accelerating the recognition of losses due to the shorter

charge-off period. In addition, we changed our loss confirmation period from two years to one year to reflect the shorter charge-

off policy and our revised servicing practices. A loss confirmation period represents the expected period between a loss event

and when management considers the debt to be uncollectible, taking into consideration account management practices that

affect the timing of a loss, such as the usage of forbearance. These two changes resulted in a $14 million net reduction in our

allowance for loan losses in 2014 because we are now only reserving for one year of expected losses as compared with two

years under the prior policy, which more than offset the impact of the shorter charge-off period.

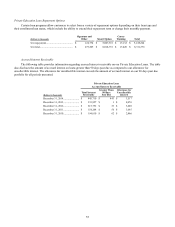

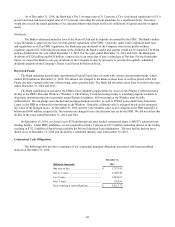

In connection with the Spin-Off, the agreement under which the Bank previously made loan sales was amended so the

Bank now only has the right to require Navient to purchase loans (at fair value) where (a) the borrower has a lending

relationship with both the Bank and Navient (“Split Loans”) and (b) the Split Loans are either (1) more than 90 days past due;

(2) have been restructured; (3) have been granted a hardship forbearance or more than six months of administrative

forbearance; or (4) have a borrower or cosigner who has filed for bankruptcy. At December 31, 2014, we held approximately

$117 million of Split Loans.

For the reasons described above, many of our historical credit indicators and period-over-period trends are not indicative

of future performance. The following results have not been adjusted to reflect what the delinquencies, charge-offs and

recoveries would have been had we not sold these loans. Because we now retain more delinquent loans, we believe it could take

up to two years before our credit performance indicators provide meaningful period-over-period comparisons.

50