Sallie Mae 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

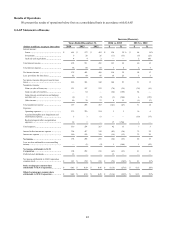

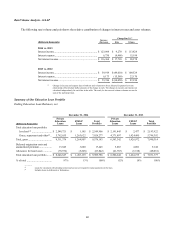

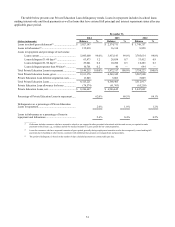

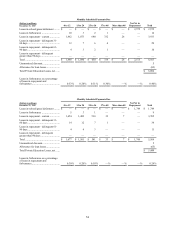

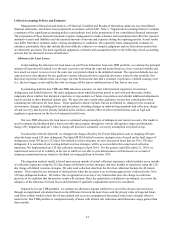

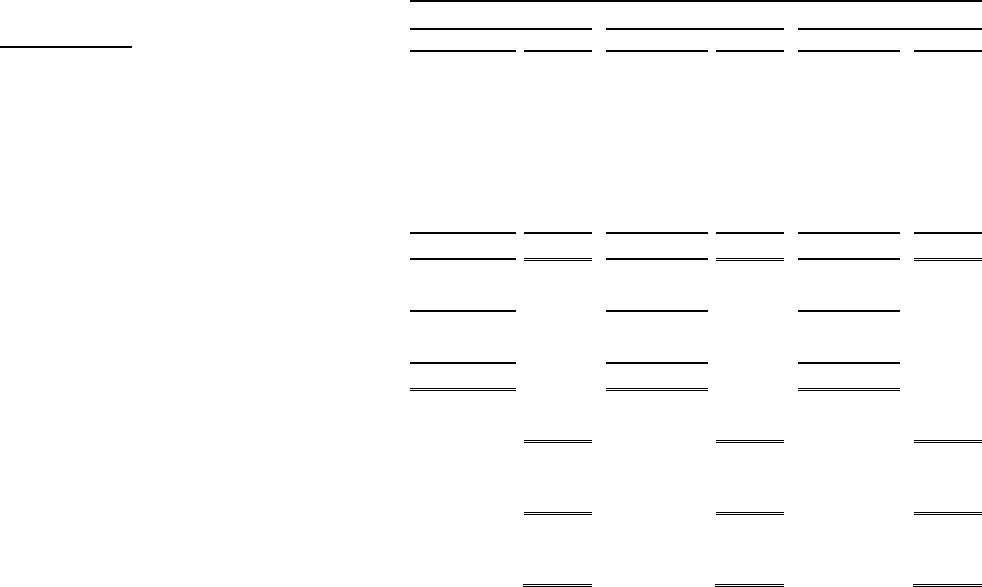

The table below presents our Private Education Loan delinquency trends. Loans in repayment includes in-school loans

making interest only and fixed payments as well as loans that have entered full principal and interest repayment status after any

applicable grace period.

December 31,

2014

2013

2012

(Dollars in thousands)

Balance

%

Balance

%

Balance

%

Loans in-school/grace/deferment(1) ..............................

$

3,027,143

$

2,574,711

$

1,748,757

Loans in forbearance(2) ...............................................

135,018

16,314

8,928

Loans in repayment and percentage of each status:

Loans current ...................................................

5,045,600

98.0

%

3,933,143

99.0

%

3,705,634

98.8

%

Loans delinquent 31-60 days(3) ..........................

63,873

1.2

28,854

0.7

33,412

0.9

Loans delinquent 61-90 days(3) ..........................

29,041

0.6

10,280

0.3

10,483

0.3

Loans delinquent greater than 90 days(3) .............

10,701

0.2

40

—

694

—

Total Private Education Loans in repayment .................

5,149,215

100.0

%

3,972,317

100.0

%

3,750,223

100.0

%

Total Private Education Loans, gross ...........................

8,311,376

6,563,342

5,507,908

Private Education Loan deferred origination costs .........

13,845

5,063

5,009

Total Private Education Loans .....................................

8,325,221

6,568,405

5,512,917

Private Education Loan allowance for losses ................

(78,574

)

(61,763

)

(65,218

)

Private Education Loans, net .......................................

$

8,246,647

$

6,506,642

$

5,447,699

Percentage of Private Education Loans in repayment .....

62.0

%

60.5

%

68.1

%

Delinquencies as a percentage of Private Education

Loans in repayment....................................................

2.0

%

1.0

%

1.2

%

Loans in forbearance as a percentage of loans in

repayment and forbearance .........................................

2.6

%

0.4

%

0.2

%

_________

(1) Deferment includes customers who have returned to school or are engaged in other permitted educational activities and are not yet required to make

payments on their loans, e.g., residency periods for medical students or a grace period for bar exam preparation.

(2) Loans for customers who have requested extension of grace period generally during employment transition or who have temporarily ceased making full

payments due to hardship or other factors, consistent with established loan program servicing policies and procedures.

(3) The period of delinquency is based on the number of days scheduled payments are contractually past due.

51