Sallie Mae 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

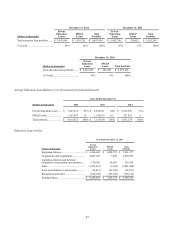

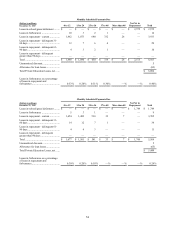

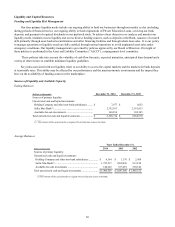

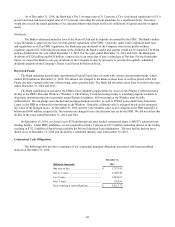

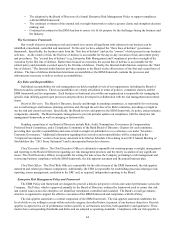

Deposits

The following table summarizes total deposits at December 31, 2014 and 2013.

December 31,

December 31,

(Dollars in thousands)

2014

2013

Deposits - interest bearing ....................................

$

10,539,953

$

8,946,514

Deposits - non-interest bearing ..............................

602

55,036

Total deposits ......................................................

$

10,540,555

$

9,001,550

Interest Bearing

Interest bearing deposits as of December 31, 2014 and 2013 consisted of non-maturity savings and money market

deposits, brokered and retail certificates of deposit, as discussed further below, and brokered money market deposits. These

deposit products are serviced by third party providers. Early withdrawal of Brokered CD’s is prohibited (except in the case of

death or legal incapacity). Placement fees associated with the brokered certificates of deposit are amortized into interest

expense using the effective interest rate method. We recognized placement fee expense of $10.3 million, $9.8 million, and $8.4

million in the years ended December 31, 2014, 2013 and 2012, respectively. Fees paid to third party brokers related to these

certificates of deposit were $15.2 million, $12.1 million, and $16.5 million during the years ended December 31, 2014, 2013

and 2012, respectively.

In the past, we offered debit cards associated with interest bearing consumer deposit (“NOW”) accounts to facilitate the

distribution of financial aid refunds and other payables to students. These debit cards were serviced by third party providers. As

of April 30, 2014, we no longer offer these debit cards.

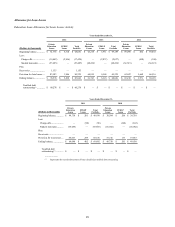

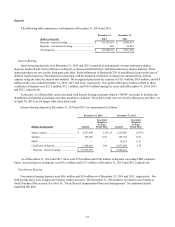

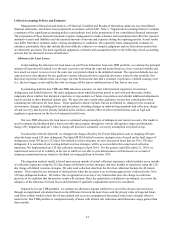

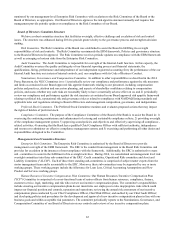

Interest bearing deposits at December 31, 2014 and 2013 are summarized as follows:

December 31, 2014

December 31, 2013

(Dollars in thousands)

Amount

Ye a r -End

Weighted

Average

Stated Rate

Amount

Ye a r -End

Weighted

Average

Stated Rate

Money market .........................................

$

4,527,448

1.15

%

$

3,212,889

0.65

%

Savings...................................................

703,687

0.81

743,742

0.81

NOW .....................................................

—

—

18,214

0.12

Certificates of deposit ..............................

5,308,818

1.00

4,971,669

1.39

Deposits - interest bearing ......................

$

10,539,953

$

8,946,514

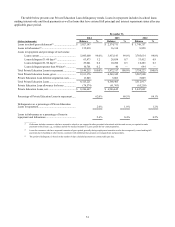

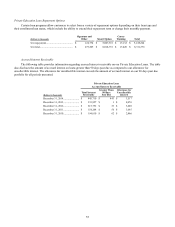

As of December 31, 2014 and 2013, there were $254 million and $160 million of deposits exceeding FDIC insurance

limits. Accrued interest on deposits was $16.1 million and $13.1 million at December 31, 2014 and 2013, respectively.

Non Interest Bearing

Non interest bearing deposits were $0.6 million and $55 million as of December 31, 2014 and 2013, respectively. For

both periods these were comprised of money market accounts. The December 31, 2014 balance is related to our Employee

Stock Purchase Plan account. See Note 14, “Stock Based Compensation Plans and Arrangements” for additional details

regarding this plan.

57