Sallie Mae 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

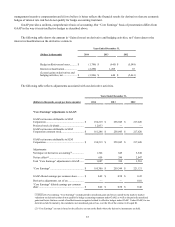

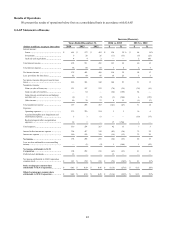

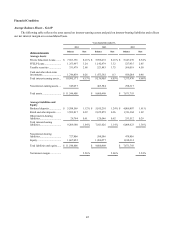

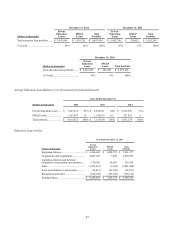

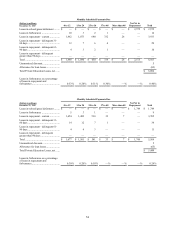

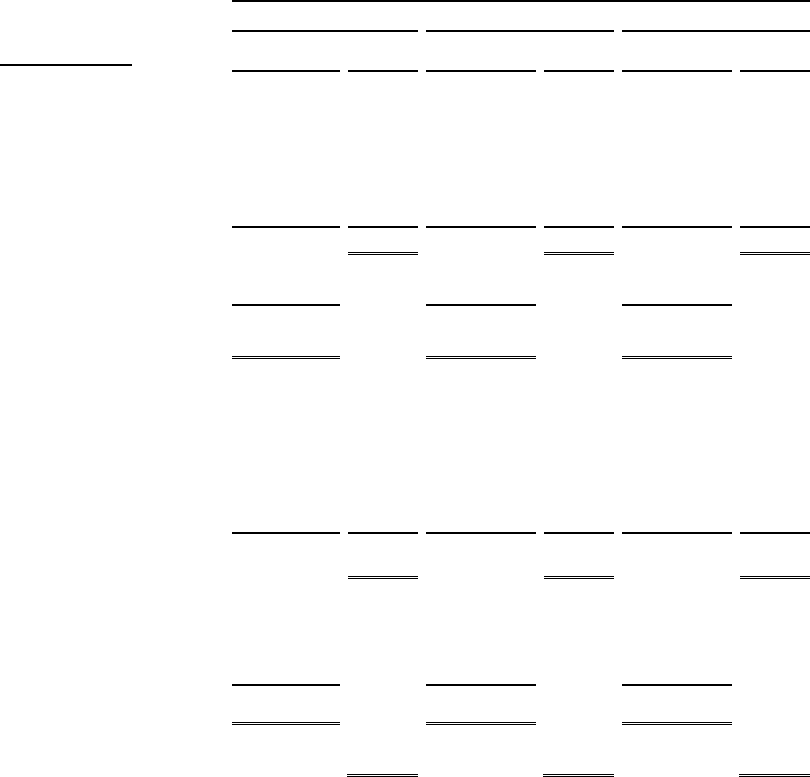

Financial Condition

Average Balance Sheets - GAAP

The following table reflects the rates earned on interest-earning assets and paid on interest-bearing liabilities and reflects

our net interest margin on a consolidated basis.

Years Ended December 31,

2014

2013

2012

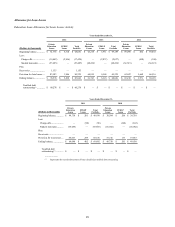

(Dollars in thousands)

Balance

Rate

Balance

Rate

Balance

Rate

Average Assets

Private Education Loans ........

$

7,563,356

8.16

%

$

5,996,651

8.16

%

$

5,347,239

8.34

%

FFELP Loans .......................

1,353,497

3.24

1,142,979

3.32

527,935

2.85

Taxable securities .................

331,479

2.68

523,883

3.75

569,018

4.50

Cash and other short-term

investments ..........................

1,746,839

0.26

1,473,392

0.3

929,284

0.48

Total interest-earning assets ...

10,995,171

6.13

%

9,136,905

6.03

%

7,373,476

6.66

%

Non-interest-earning assets ....

549,237

463,584

298,317

Total assets ..........................

$

11,544,408

$

9,600,489

$

7,671,793

Average Liabilities and

Equity

Brokered deposits .................

$

5,588,569

1.12

%

$

5,015,201

1.24

%

$

4,009,807

1.61

%

Retail and other deposits .......

3,593,817

0.92

2,675,879

0.96

1,741,304

1.02

Other interest-bearing

liabilities ..............................

26,794

0.91

120,546

0.92

253,512

0.29

Total interest-bearing

liabilities ..............................

9,209,180

1.04

%

7,811,626

1.14

%

6,004,623

1.38

%

Non-interest-bearing

liabilities ..............................

727,806

588,586

478,856

Equity .................................

1,607,422

1,200,277

1,188,314

Total liabilities and equity......

$

11,544,408

$

9,600,489

$

7,671,793

Net interest margin ...............

5.26

%

5.06

%

5.54

%

45