Sallie Mae 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

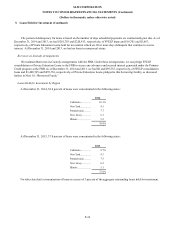

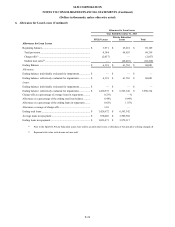

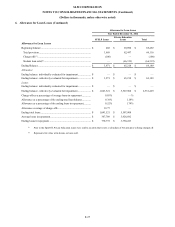

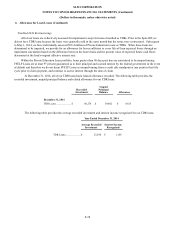

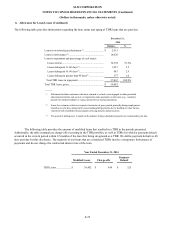

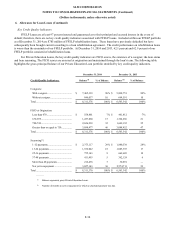

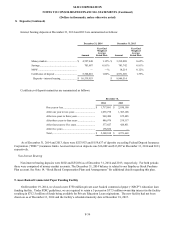

6. Allowance for Loan Losses

Our provision for Private Education Loan losses represents the periodic expense of maintaining an allowance sufficient to

absorb incurred probable losses in the held-for-investment loan portfolios. The evaluation of the allowance for loan losses is

inherently subjective, as it requires material estimates that may be susceptible to significant changes. We believe the allowance

for loan losses is appropriate to cover probable losses incurred in the loan portfolios. See Note 2, “Significant Accounting

Policies — Allowance for Private Education Loan Losses” for a more detailed discussion.

Allowance for Loan Losses Metrics

Allowance for Loan Losses

Year Ended December 31, 2014

FFELP Loans

Private Education

Loans

Total

Allowance for Loan Losses

Beginning balance ...................................................................

$

6,318

$

61,763

$

68,081

Total provision......................................................................

1,946

83,583

85,529

Charge-offs

(1)

.....................................................................

(2,996

)

(14,442

)

(17,438

)

Recoveries .........................................................................

—

1,155

1,155

Net charge-offs .....................................................................

(2,996

)

(13,287

)

(16,283

)

Student loan sales

(2)

...............................................................

—

(53,485

)

(53,485

)

Ending Balance .......................................................................

$

5,268

$

78,574

$

83,842

Allowance:

Ending balance: individually evaluated for impairment ...............

$

—

$

9,815

$

9,815

Ending balance: collectively evaluated for impairment ................

$

5,268

$

68,759

$

74,027

Loans:

Ending balance: individually evaluated for impairment ...............

$

—

$

59,402

$

59,402

Ending balance: collectively evaluated for impairment ................

$

1,264,807

$

8,251,974

$

9,516,781

Net charge-offs as a percentage of average loans in repayment .....

0.31

%

0.30

%

Allowance as a percentage of the ending total loan balance ..........

0.42

%

0.95

%

Allowance as a percentage of the ending loans in repayment ........

0.57

%

1.53

%

Allowance coverage of net charge-offs ......................................

1.76

5.91

Ending total loans ....................................................................

$

1,264,807

$

8,311,376

Average loans in repayment ......................................................

$

972,390

$

4,495,709

Ending loans in repayment .......................................................

$

926,891

$

5,149,215

_________

(1) Prior to the Spin-Off, Private Education Loans were sold to an entity that is now a subsidiary of Navient, prior to being charged off.

(2) Represents fair value write-downs on loans sold.

F-25