Sallie Mae 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Off SLM’s Private Education Loan default aversion strategies were focused on the final stages of delinquency, from 150 days to

212 days. As a result of changing our corporate charge-off policy to charging off at 120 days delinquent and greatly reducing

the number of potentially delinquent loans we sell to Navient, our default aversion strategies must now focus more on loans 30

to 120 days delinquent. We have little experience in executing our default aversion strategies on such compressed collection

timeframes. If we are unable to maintain or improve on our existing default aversion levels during these shortened collection

timeframes default rates on our Private Education Loans could increase.

Our allowance for loan losses may not be adequate to cover actual losses, and we may be required to materially increase our

allowance, which may adversely affect our capital, financial condition, and results of operations.

The evaluation of our allowance for loan losses is inherently subjective, as it requires material estimates that may be

subject to significant changes. As of December 31, 2014, our allowance for Private Education Loan losses was approximately

$79 million. During the year ended December 31, 2014, we recognized provisions for Private Education Loan losses of $84

million. The provision for loan losses reflects the activity for the applicable period and provides an allowance at a level that

management believes is appropriate to cover probable losses inherent in the loan portfolio. However, future defaults can be

higher than anticipated due to a variety of factors outside of our control, such as downturns in the economy, regulatory or

operational changes and other unforeseen future trends. Losses on Private Education Loans are also determined by risk

characteristics such as school type, loan status (in-school, grace, forbearance, repayment and delinquency), loan seasoning

(number of months in active repayment), underwriting criteria (e.g., credit scores), presence of a cosigner and the current

economic environment. General economic and employment conditions, including employment rates for recent college

graduates during the recent recession, led to higher rates of education loan defaults. If actual loan performance is worse than

currently estimated, it could materially affect our estimate of the allowance for loan losses and the related provision for loan

losses in our statements of income and, as a result, adversely affect our financial condition and results of operations.

The Bank is subject to various regulatory capital requirements administered by the FDIC and the UDFI. Failure to meet

minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by regulators

that, if undertaken, could have a material adverse effect on our business, results of operations and financial position.

Under the regulatory framework for prompt corrective action, the Bank must meet specific capital guidelines that involve

quantitative measures of our assets, and certain off-balance sheet items as calculated under regulatory accounting practices. The

Bank’s capital amounts and classification are also subject to qualitative judgments by the regulators about components, risk-

weightings and other factors.

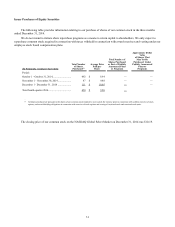

Beginning January 1, 2015, the Bank must comply with the FDIC’s final rule implementing the Basel III capital

framework related to regulatory capital measurement and reporting. The rule strengthens both the quantity and quality of risk-

based capital for all banks, placing greater emphasis on Tier 1 common equity capital. Under the new rule, well-capitalized

institutions will be required to maintain a minimum Tier 1 Leverage ratio of 5 percent, a minimum Tier 1 common equity risk-

based capital ratio of 6.5 percent, a minimum Tier 1 risk-based capital of 8 percent and minimum total risk-based capital of 10

percent. In addition, a capital conservation buffer will be phased in over four years beginning on January 1, 2016, as follows:

the maximum buffer will be 0.625 percent of risk weighted assets for 2016, 1.25 percent for 2017, 1.875 percent for 2018 and

2.5 percent for 2019 and beyond, resulting in the following minimum ratios beginning in 2019: a Tier 1 common equity risk-

based capital ratio of a minimum 7.0 percent, a Tier 1 capital ratio of a minimum 8.5 percent and a total risk-based capital ratio

of a minimum 10.5 percent. As of December 31, 2014, the Bank had a Tier 1 leverage ratio of 11.5 percent, a Tier 1 risk-based

capital ratio of 15.0 percent and total risk-based capital ratio of 15.9 percent. If the FDIC’s final rule were effective on

December 31, 2014, the ratios would be Tier 1 leverage ratio of 11.5 percent, Tier 1 risk-based capital ratio of 14.6 percent and

total risk-based capital ratio of 15.5 percent.

Institutions that do not maintain the capital conservation buffer could face restrictions on dividend payments, share

repurchases and the payment of discretionary bonuses. If the Bank fails to satisfy regulatory capital or leverage capital

requirements, it may be subject to serious regulatory sanctions which could also have an impact on us. If any of these sanctions

were to occur, they could prevent us from successfully executing our business plan and may have a material adverse effect on

our business, results of operations and financial position.

Unfavorable results from ongoing stress tests conducted by us may adversely affect our capital position.

The Dodd-Frank Act imposes stress test requirements on banking organizations with total consolidated assets, averaged

over the four most recent consecutive quarters, of more than $10 billion. As of December 31, 2014, the Bank has met this asset

threshold. Under the FDIC’ s implementing regulations, the Bank is required to conduct annual stress tests utilizing scenarios

provided by the FDIC and publish a summary of those results. The Bank must conduct its first annual stress test under the rules

in the January 1, 2016 stress testing cycle and submit the results of that stress test to the FDIC by July 31, 2016. Published

summary results will be required to include certain measures that evaluate the Bank’s ability to absorb losses in severely

21