Sallie Mae 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

2.

Significant Accounting Policies (Continued)

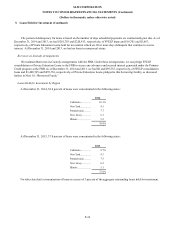

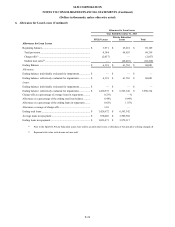

Allowance for FFELP Loan Losses

FFELP Loans are insured as to their principal and accrued interest in the event of default subject to a Risk Sharing level

based on the date of loan disbursement. These insurance obligations are supported by contractual rights against the United

States. For loans disbursed on or after July 1, 2006, we receive 97 percent reimbursement. For loans disbursed after October 1,

1993, and before July 1, 2006, we receive 98 percent reimbursement on all qualifying default claims. For loans disbursed prior

to October 1, 1993, we receive 100 percent reimbursement.

Similar to the allowance for Private Education Loan losses, the allowance for FFELP Loan losses uses historical

experience of customer default behavior and a two-year loss confirmation period to estimate the credit losses incurred in the

loan portfolio at the reporting date. We apply the default rate projections, net of applicable Risk Sharing, to each category for

the current period to perform our quantitative calculation. Once the quantitative calculation is performed, we review the

adequacy of the allowance for loan losses and determine if qualitative adjustments need to be considered.

Deposits

Our deposit accounts are principally certificates of deposit (“CD”), money market deposit accounts (“MMDA”) and high

yield savings (“HYS”) accounts. CDs are accounts that have a stipulated maturity and interest rate. Early withdrawal of

Brokered CD’s is prohibited (except in the case of death or legal incapacity). Retail CD’s may be withdrawn early but a penalty

is assessed. MMDA and HYS accounts are both interest and non-interest bearing accounts that have no maturity or expiration

date. The depositor is not required by the deposit contract, but may at any time be required by the Company, to give written

notice of any intended withdrawal not less than seven days before the withdrawal is made.

Upromise related liabilities

Upromise related liabilities represent amounts owed to Upromise rewards members for rebates they have earned from

qualifying purchases from Upromise’s participating companies. These amounts are held in trust for the benefit of the members

until distributed in accordance with the Upromise member’s request and/or the terms of the Upromise service agreement.

Upromise, which acts as the trustee for the trust, has deposited a majority of the cash with the Bank pursuant to a money market

deposit account agreement between the Bank and Upromise as trustee of the trust.

Fair Value Measurement

We use estimates of fair value in applying various accounting standards for our financial statements. Fair value

measurements are used in one of five ways:

• In the consolidated balance sheet with changes in fair value recorded in the consolidated statement of income;

• In the consolidated balance sheet with changes in fair value recorded in the accumulated other comprehensive income

section of the consolidated statement of changes in equity;

• In the consolidated balance sheet for instruments carried at lower of cost or fair value with impairment charges recorded

in the consolidated statement of income;

• In the notes to the consolidated financial statements; and

• In the measurement of related party transactions.

Fair value is defined as the price to sell an asset or transfer a liability in an orderly transaction between willing and able

market participants. In general, our policy in estimating fair value is to first look at observable market prices for identical assets

and liabilities in active markets, where available. When these are not available, other inputs are used to model fair value such as

prices of similar instruments, yield curves, volatilities, prepayment speeds, default rates and credit spreads (including for our

liabilities), relying first on observable data from active markets. Depending on current market conditions, additional

adjustments to fair value may be based on factors such as liquidity, credit, and bid/offer spreads. Transaction costs are not

included in the determination of fair value. When possible, we seek to validate the model’ s output to market transactions.

F-16