Sallie Mae 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

12.

Stockholders' Equity (Continued)

Receivable/Payable with Affiliate

All significant intercompany payable/receivable balances between the Bank and pre-Spin-Off SLM are considered to

be effectively settled for cash in the combined financial statements at the time the transaction is recorded.

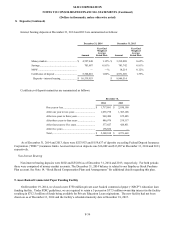

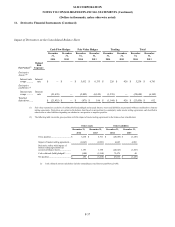

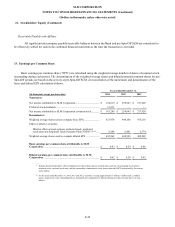

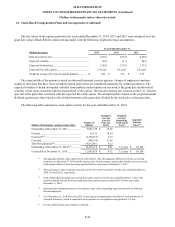

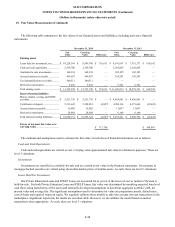

13. Earnings per Common Share

Basic earnings per common share (“EPS”) are calculated using the weighted average number of shares of common stock

outstanding during each period. The determination of the weighted-average shares and diluted potential common shares for pre-

Spin-Off periods are based on the activity at pre-Spin-Off SLM. A reconciliation of the numerators and denominators of the

basic and diluted EPS calculations follows.

Years Ended December 31,

(In thousands, except per share data)

2014

2013

2012

Numerator:

Net income attributable to SLM Corporation .................................

$

194,219

$

258,945

$

217,620

Preferred stock dividends ............................................................

12,933

—

—

Net income attributable to SLM Corporation common stock ...........

$

181,286

$

258,945

$

217,620

Denominator:

Weighted average shares used to compute basic EPS ......................

423,970

440,108

476,118

Effect of dilutive securities:

Dilutive effect of stock options, restricted stock, restricted

stock units and Employee Stock Purchase Plan ("ESPP")

(1)(2)

....

8,299

8,441

6,774

Weighted average shares used to compute diluted EPS ...................

432,269

448,549

482,892

Basic earnings per common share attributable to SLM

Corporation ..............................................................................

$

0.43

$

0.59

$

0.46

Diluted earnings per common share attributable to SLM

Corporation ..............................................................................

$

0.42

$

0.58

$

0.45

__________

(1) Includes the potential dilutive effect of additional common shares that are issuable upon exercise of outstanding stock options,

restricted stock, restricted stock units, and the outstanding commitment to issue shares under the ESPP, determined by the treasury

stock method.

(2) For the years ended December 31, 2014, 2013 and 2012, securities covering approximately 3 million, 3 million and 12 million

shares, respectively, were outstanding but not included in the computation of diluted earnings per share because they were anti-

dilutive.

F-42