Sallie Mae 2014 Annual Report Download - page 102

Download and view the complete annual report

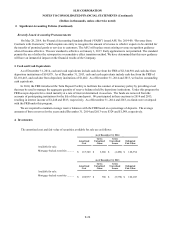

Please find page 102 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

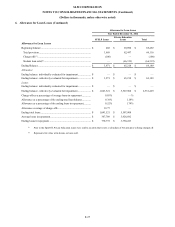

2.

Significant Accounting Policies (Continued)

December 31, 2014, 2013 and 2012, respectively. Subsequent to the Spin-Off, we sold loans through loan sales and a

securitization transaction with third parties (including Navient) resulting in a net gain on sale of loans of $85 million for the

year ended December 31, 2014. See notes to consolidated financial statements, Note 16, “Arrangements with Navient

Corporation,” for further discussion regarding loan purchase agreements. While there may be near-term Private Education Loan

sales to Navient to facilitate an orderly transition after the Spin-Off, neither the Company nor Navient has any ongoing

obligation to buy or sell Private Education Loans to or from the other.

Other Income

Our Upromise subsidiary has a number of programs that encourage consumers to save for the cost of college education.

We have established a consumer savings network which is designed to promote college savings by consumers who are members

of this program by encouraging them to purchase goods and services from the companies that participate in the program.

Participating companies generally pay Upromise fees based on member purchase volume, either online or in stores depending

on the contractual arrangement with the company. We recognize revenue as marketing and administrative services are rendered

based upon contractually determined rates and member purchase volumes.

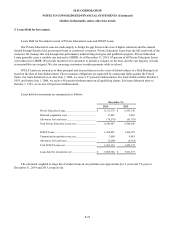

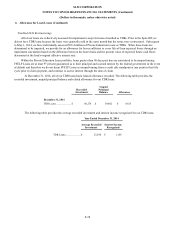

Securitization Accounting

In the third quarter 2014, we entered into our first securitization transaction. We accounted for this as a sale of loans and

we did not consolidate the securitization trust. This securitization used a two-step structure with a special purpose entity that

legally isolated the transferred assets from us, even in the event of bankruptcy. The transaction was also structured to ensure the

holders of the beneficial interests issued are not constrained from pledging or exchanging their interests, and we do not

maintain effective control over the transferred assets. If these criteria had not been met, then the transaction would be accounted

for as an on-balance sheet secured borrowing. Our securitization transaction was legally structured to be a sale of assets that

isolated the transferred assets from us. If a securitization qualifies as a sale, we then assess whether we are the primary

beneficiary of the securitization trust and are required to consolidate such trust. If we are the primary beneficiary then no gain

or loss is recognized.

The investors in the securitization trust have no recourse to our assets should there be a failure of the trust to pay when

due. Generally, the only recourse the trust has to us is in the event we breach a seller representation or warranty or our duties as

master servicer, in which event we agree to repurchase the related loans from the trust. As master servicer, our primary

responsibility will be to monitor the performance of the subservicer and find a substitute subservicer in the event the

subservicer of the trust defaults.

We did not record a servicing asset or servicing liability related to the securitization transaction we entered into in third

quarter 2014 because we determined the master servicing fee we receive is at market rate.

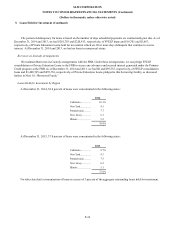

Derivative Accounting

We account for our derivatives, consisting of interest rate swaps, at fair value on the consolidated balance sheets as either

an asset or liability. Derivative positions are recorded as net positions by counterparty based on master netting arrangements

(see Note 11, “Derivative Financial Instruments”) exclusive of accrued interest and cash collateral held or pledged. We

determine the fair value for our derivative contracts primarily using pricing models that consider current market conditions and

the contractual terms of the derivative contract. These factors include interest rates, time value, forward interest rate curves, and

volatility factors. Inputs are generally from active financial markets.

The majority of our derivatives qualify as effective hedges. For these derivatives, the relationship between the hedging

instrument and the hedged items (including the hedged risk and method for assessing effectiveness), as well as the risk

management objective and strategy for undertaking various hedge transactions at the inception of the hedging relationship, is

documented.

Each derivative is designated to a specific (or pool of) liability(ies) on the consolidated balance sheets, and is designated

as either a “fair value” hedge or a “cash flow” hedge. Fair value hedges are designed to hedge our exposure to changes in fair

value of a fixed-rate liability. For effective fair value hedges, both the hedge and the hedged item (for the risk being hedged) are

F-18