Sallie Mae 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

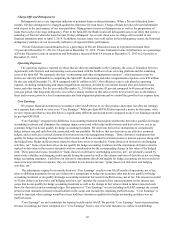

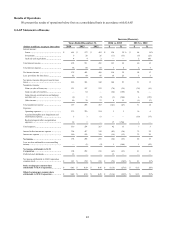

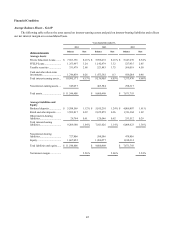

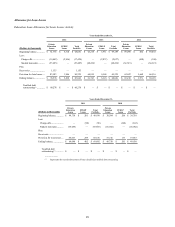

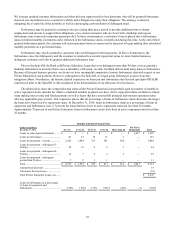

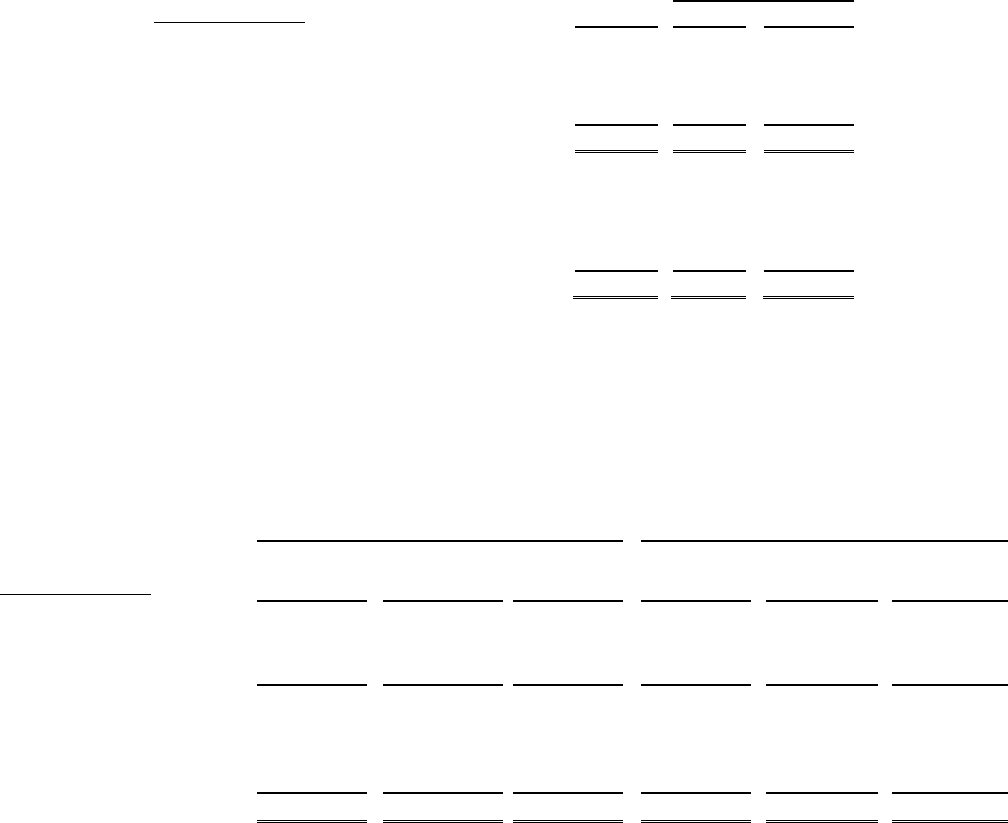

Rate/Volume Analysis - GAAP

The following rate/volume analysis shows the relative contribution of changes in interest rates and asset volumes.

(Dollars in thousands)

Increase

(Decrease)

Change Due To

(1)

Rate

Volume

2014 vs. 2013

Interest income ............................................................

$

123,094

$

9,270

$

113,824

Interest expense ...........................................................

6,730

(8,468

)

15,198

Net interest income ......................................................

$

116,364

$

17,738

$

98,978

2013 vs. 2012

Interest income ............................................................

$

59,919

$

(49,610

)

$

109,529

Interest expense ...........................................................

6,173

(15,560

)

22,170

Net interest income ......................................................

$

53,746

$

(34,050

)

$

87,390

(1) Changes in income and expense due to both rate and volume have been allocated in proportion to the

relationship of the absolute dollar amounts of the change in each. The changes in income and expense are

calculated independently for each line in the table. The totals for the rate and volume columns are not the

sum of the individual lines.

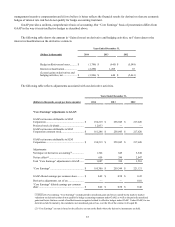

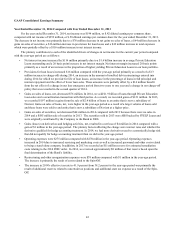

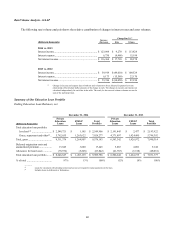

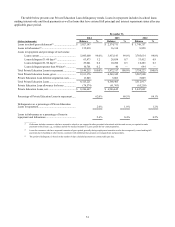

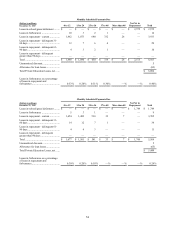

Summary of Our Education Loan Portfolio

Ending Education Loan Balances, net

December 31, 2014

December 31, 2013

(Dollars in thousands)

Private

Education

Loans

FFELP

Loans

Total

Portfolio

Private

Education

Loans

FFELP

Loans

Total

Portfolio

Total education loan portfolio:

In-school

(1)

............................

$

2,548,721

$

1,185

$

2,549,906

$

2,191,445

$

2,477

$

2,193,922

Grace, repayment and other

(2)

..

5,762,655

1,263,622

7,026,277

4,371,897

1,424,495

5,796,392

Total, gross .................................

8,311,376

1,264,807

9,576,183

6,563,342

1,426,972

7,990,314

Deferred origination costs and

unamortized premium ..................

13,845

3,600

17,445

5,063

4,081

9,144

Allowance for loan losses ............

(78,574

)

(5,268

)

(83,842

)

(61,763

)

(6,318

)

(68,081

)

Total education loan portfolio .......

$

8,246,647

$

1,263,139

$

9,509,786

$

6,506,642

$

1,424,735

$

7,931,377

% of total ...................................

87

%

13

%

100

%

82

%

18

%

100

%

_________

(1) Loans for customers still attending school and are not yet required to make payments on the loan.

(2) Includes loans in deferment or forbearance.

46