Sallie Mae 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

12. Stockholders' Equity

Preferred Stock

At December 31, 2014, we had outstanding 3.3 million shares of 6.97 percent Cumulative Redeemable Preferred Stock,

Series A (the “Series A Preferred Stock”) and 4.0 million shares of Floating-Rate Non-Cumulative Preferred Stock, Series B

(the “Series B Preferred Stock”). In connection with the Spin-Off, the Company, by reason of a statutory merger, succeeded

pre-Spin-Off SLM and issued Series A Preferred Stock and Series B Preferred Stock, on terms substantially similar to those of

pre-Spin-Off SLM's respective series of preferred stock. Neither series has a maturity date but can be redeemed at our option.

Redemption would include any accrued and unpaid dividends up to the redemption date. The shares have no preemptive or

conversion rights and are not exchangeable for any of our other securities or property. Dividends on both series are not

mandatory and are paid quarterly, when, as, and if declared by the Board of Directors. Holders of Series A Preferred Stock are

entitled to receive cumulative, quarterly cash dividends at the annual rate of $3.485 per share. Holders of Series B Preferred

Stock are entitled to receive quarterly dividends based on 3-month LIBOR plus 170 basis points per annum in arrears. Upon

liquidation or dissolution of the Company, holders of the Series A and Series B Preferred Stock are entitled to receive $50 and

$100 per share, respectively, plus an amount equal to accrued and unpaid dividends for the then current quarterly dividend

period, if any, pro rata, and before any distribution of assets are made to holders of our common stock.

Common Stock

Our shareholders have authorized the issuance of 1.125 billion shares of common stock (par value of $.20). At

December 31, 2014, 423 million shares were issued and outstanding and 60 million shares were unissued but encumbered for

outstanding stock options, restricted stock units and dividend equivalent units for employee compensation and remaining

authority for stock-based compensation plans.

Because of the carve-out accounting treatment, there were no common stock dividends recognized in these financial

statements for the years ended December 31, 2014, 2013 and 2012. For additional information, see Note 2, “Significant

Accounting Policies — Basis of Presentation.”

We currently do not intend to initiate a publicly announced share repurchase program. We only expect to repurchase

common stock acquired in connection with taxes withheld in connection with award exercises and vesting under our employee

stock-based compensation plans. The following table summarizes our common share repurchases and issuances associated

with these programs.

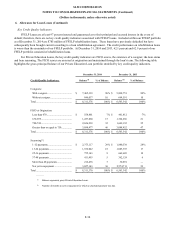

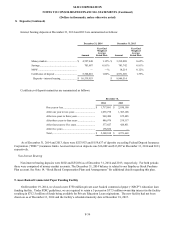

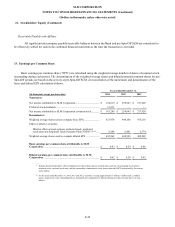

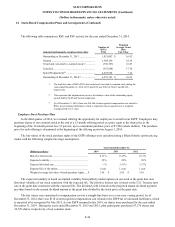

Years Ended December 31,

(Shares and per share amounts in actuals)

2014

2013

2012

Shares repurchased related to employee stock-based

compensation plans

(1)

..............................................................

1,365,277

6,365,002

4,547,785

Average purchase price per share..............................................

$

8.93

$

21.76

$

15.86

Common shares issued(2) .........................................................

2,013,805

9,702,976

6,432,643

(1) Comprises shares withheld from stock option exercises and vesting of restricted stock for employees’ tax withholding obligations and shares

tendered by employees to satisfy option exercise costs.

(2) Common shares issued under our various compensation and benefit plans.

The closing price of our common stock on December 31, 2014 was $10.19.

F-40