Sallie Mae 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

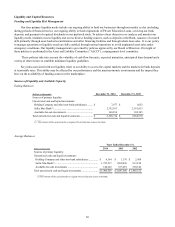

Counterparty Exposure

Counterparty exposure related to financial instruments arises from the risk that a lending, investment or derivative

counterparty will not be able to meet its obligations to us.

Excess cash is generally invested with the Federal Reserve on an overnight basis or in the Federal Reserve’s Term

Deposit Facility, minimizing counterparty exposure on cash balances.

Our investment portfolio includes a small portfolio of mortgage-backed securities issued by government agencies and

government-sponsored enterprises that are purchased to meet Community Reinvestment Act targets. Additionally, our investing

activity is governed by Board-approved limits on the amount that is allowed to be invested with any one issuer based on the

credit rating of the issuer, further minimizing our counterparty exposure. Counterparty credit risk is considered when valuing

investments and considering impairment.

Related to derivative transactions, protection against counterparty risk is generally provided by International Swaps and

Derivatives Association, Inc. (“ISDA”) Credit Support Annexes (“CSAs”), or clearinghouses for Over the Counter (“OTC”)

derivatives. CSAs require a counterparty to post collateral if a potential default would expose the other party to a loss. All

derivative contracts entered into by the Bank are covered under such agreements and require collateral to be exchanged based

on the net fair value of derivatives with each counterparty. Our exposure is limited to the value of the derivative contracts in a

gain position less any collateral held or in addition to collateral posted.

Title VII of the Dodd-Frank Act requires all standardized derivatives, including most interest rate swaps, to be submitted

for clearing to central counterparties to reduce counterparty risk. As of December 31 2014, $4.0 billion notional of our

derivative contracts were cleared on the Chicago Mercantile Exchange and the London Clearing House. All derivative

contracts cleared through an exchange require collateral to be exchanged based on the fair value of the derivative. Our

exposure is limited to the value of the derivative contracts in a gain position net of any collateral we are holding.

We have liquidity exposure related to collateral movements between us and our derivative counterparties. Movements in

the value of the derivatives, which are primarily affected by changes in interest rates, may require us to return cash collateral

held or may require us to access primary liquidity to post collateral to counterparties.

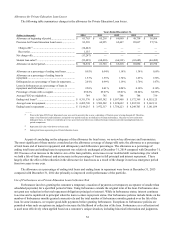

The table below highlights exposure related to our derivative counterparties as of December 31, 2014.

(Dollars in thousands)

SLM Corporation

and Sallie Mae Bank

Contracts

Exposure, net of collateral....................................................

$

60,784

Percent of exposure to counterparties with credit ratings

below S&P AA- or Moody’s Aa3 ..........................................

38.73

%

Percent of exposure to counterparties with credit ratings

below S&P A- or Moody’s Baa .............................................

0.01

%

58